Elite Trader Trades False Break Setup With 200 Lots Introduction

In this blog post, we will review how Elite trader trades false break setup with 200 lots. If you are a frequent reader of our blog, you are familiar with the different styles of Axia Elite traders that range from news-driven aggressive trades to very technical ones. The style of this particular trader is very technical and over the years he has become a master of market profiles, a true Market Profile engineer. This trading setup is aligned well with the bigger picture structure and poor lows that should get resolved are the ideal location for the reversal of the trade and bullish continuation. If you like the style of this trader, you might also like the trade he took in the past in Eurostoxx where he executed 1000 lot trade.

This trade is based on the video down below.

Elite Trader Trade Setup

Bigger Picture Structure

Overall this setup is aligned well with the bigger market structure. The market has a bullish skew (long red arrow on the picture above), with higher lows being formed over many days. Over the course of the last 3 days, the market has created both poor highs and poor lows. Given the bigger picture structure being skewed bullish, this poor low location might be the ideal point for a reversal and continuation of trade to resolve the poor highs. These are the Elite trader clues in regards to the trade:

- the market is trading in a 3-day balance near the highs of the bigger picture structure

- the market has a bullish higher time frame setup suggesting support below this balance

- highs of balance are poor (no tails) suggesting weak sellers

- 4TPO ledge at 3332, and balance lows at 3330 are an ideal candidate for repair before we continue higher

- There is a poor low in Spoo that might help push other equities like Eurostoxx lower

Given the information about the overall bullish market structure, poor lows, and highs this is how an Elite trader formulated the trade idea:

- A higher timeframe structure makes it (a) hard for the market to be bearish and (b) makes a false break (FB) of lows at 3330 likely if the market tries

- 4TPO ledge at 3332 needs to be resolved

- Use break of 4TPO ledge as liquidity for entry to a long

- Have a high conviction that a break of 3330 will become a false break setup if the market won’t show seller’s strength (no tails at highs)

Let’s have a look at the actual detail of trade execution.

Trade Execution And Price Ladder

If you read through the observations of this trader, one thing is clear. If the poor lows 4TPO ledge will get repaired, it is all about HOW. As the market pushes to the trader’s entry price, he observes the sellers strength activity. He asks three important questions:

- What is the price response from buyers?

- What is the strength of sellers?

- Is there any absorption happening around the key access zone?

You can watch the direct recording from the price ladder here and notice how this trader sizes the trade with sizing up from 0 to 200lots.

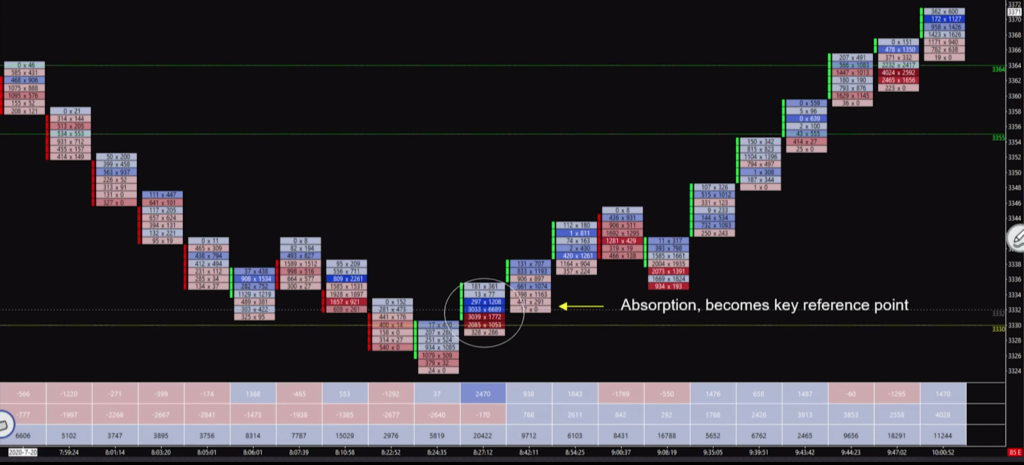

As you can see down below, the market has dipped through the poor low, repaired the low, and in a nearly V-like fashion reversed the overall move but not immediately. You had to sit with the trade for a little while at the beginning phase of this trade. The absorption at the lows as visible on the footprint has become a key reference point. This trader did not want to see many more tests of this level given the overall bullish picture of the structure.

Now to wrap this up. One observation is that this Elite trader always anchors short-term info in the higher time frame info. Also, when the info aligns across all of the timeframes (including PA and correlations) you have probabilities in your favor and can lean on this in your conviction. If you want to learn how this Elite trader used our proprietary materials and grew to become an 8-figure trader, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK