Elastic Band And VPOC Reversal Trading Strategy Introduction

In this article, we will combine Elastic band and VPOC confluence for our trading strategy. Specifically, we will look at Bund and how similar price action repeated twice in one week. Continue reading below and find out, how you can combine a reasonable location for entry using the VPOC (volume point of control) and fast drop that is followed by absorption using tools such as price ladder and market profile. If you are interested in similar market reversal strategies, don’t forget to check out our previous article on V reversal trading strategy.

This article is based on the video down below.

Trading Mechanics Of The Reversal Strategy

This strategy essentially combines several market clues:

- Market is directional – in this case, Bund is in the uptrend

- Elastic band – market escapes quickly the previous range. Sellers are dominant leading into this strategy

- VPOC – your location for entry is the previous VPOC, where the market should find absorption

- Absorption – you wait for the market to start confirming your thesis by watching how one side is willing to eat what the other side has to offer (read more below)

Ok, now let’s have a look at how the market clues manifested in the chart:

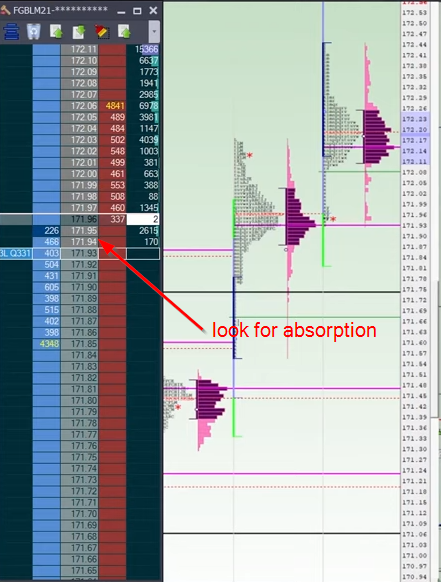

As you can see in the market profile chart above, we are combining all the market clues we have described. The previous VPOC, the escape from the range on a fast move aka Elastic band and absorption. Why absorption? Well, we want to see, that participants are truly interested in the location we have selected. Given that in AXIA we combine all the tools together, you would need price ladder (or its derivation footprint) to understand what is going on. Let’s have a brief look at what the price ladder is telling us.

Using Absorption On The Price Ladder To Get Into The Reversal Strategy

Now that you know what to look for at the high level. Let’s zoom in on the price ladder.

Now, it is time to replay the price ladder. If you have not done so, please do here where the video starts from the price ladder timestamp. If you have watched the video, you must have noticed how 95 keeps reloading. What does reloading mean? Every time the bid gets hit and the size is eaten, it reappears again. This is a sign that buyers are willing to constantly step in – to reload their bid. This constant stepping-in is the reloading that leads to absorption. But not so quickly.

How Patience Plays A Big Role In The Success Of The Reversal Strategy

Given the straightforward criteria to enter, there is one criterion that takes screen time to master. Patience. Yes, patience is required in many other aspects of the trading but for this specific strategy, this is not a straight-line move strategy. There is nobody caught in a hole who needs to unwind. Quite the opposite. You need to understand that for some time, you will be sitting in an uncomfortable position. Why? Because you are entering a trade, where sellers are the dominant force and it takes a while for buyers to become one. This trade took an hour and twenty minutes from entry to target. Here is the 1minute chart.

As you can see by the entry, you were onsite a few ticks, then it comes back. Then onsite again. Then back to the very low probably being uncomfortable for some time. The moment market got absorbed all the selling, that was the moment buyers slowly stepped in, leading the market to your target which was the start of the LVN zone created by the fast drop aka Elastic band move. And that’s it for today.

If you liked this article, you might check these videos as well:

- 3 Types Of Price Level Breakout Trading

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

And if you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK