Open Drive Trading Strategies Introduction

In this post, we will look at the open drive trading strategies. Specifically, we will look at how Junior AXIA trader Isaac executed these strategies. What was the rationale behind choosing this particular strategy and how it played out? Technically we can all understand the mechanics of the open drive, but it is the context behind the strategy, not just reading the opening flows that make this strategy a good strategy to have in your trading playbook.

We are selecting the strategies from our YouTube channel Axia Traders, where Isaac shares his daily views on the markets right from the trading floor.

Open Drive Strategies

Before we get to the actual trading strategies, it is important to explain what an open drive is. The open drive is a strategy, where we expect directional move straight of the open. We expect the initiative from either side. An initiative that is clearly manifested in the price ladder order flow. Before the Globex, this used to be an even more dominant strategy due to the nature of market participants wanting to buy or sell immediately when the market opened, being the first one to buy or sell. If you would like to get the full picture understanding, watch Richard explaining the open drive mechanics.

In the strategies below, we will look at two products: ES (Spoo) and Eurostoxx (Stoxx) executed by Isaac.

Open Drive Strategy #1

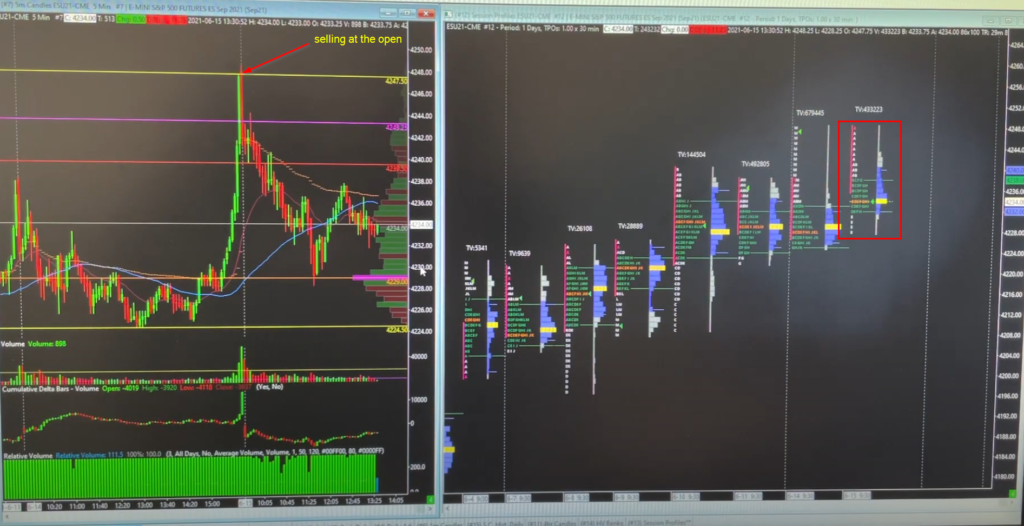

Right before we deep dive into the detail, it is important to remind us what we have mentioned at the beginning of the article in regards to context. We just don’t happen to be selling any initiative orderflow from the open. The reason why we choose the open drive strategy has to have some contextual backing. In the first strategy, Isaac is trying to play the fade of the extended move. This extension prior to the open is getting a bit stretched so the idea is to apply the mean-reversion market dynamic and target the previously significant balance area. Also, there is an overnight positioning holding above yesterday’s cash close that could not lift the market any further. This positioning might provide us with extra push if/when the unwind will have to happen. This can also be referred to as a “caught in a hole” trade (find out more about what the “caught in a hole” strategy is and how to trade it).

As you can see Isaac combined several clues that created his context to take the open drive trade:

- sideway action over several days, trying to bid up

- leaving poor low before bidding up into the close (possible vulnerable target)

- overnight weak positioning that Isaac was looking for that market will squeeze it at the open

All with potential target either VA or the poor low from the day before. Then Isaac executed his short order straight from the cash open. See his price ladder execution that starts here.

Open Drive Strategy #2

In this second strategy, Isaac was looking to buy at the open. Why? Again, he was looking for vulnerability to attack. The market has left multiple excess highs (see image above) for our possible target. But it was not just the vulnerable highs. It was Isaac’s understanding of the overall structure. With month-end liquidation move leading into the buying tail that happened several days before, he wanted to combine a bullish fuel behind the Stoxx from the tail bounce and vulnerable high from the previous non-excess highs.

To wrap up the clues, here is the list:

- Vulnerable non-excess highs to attack

- Month-end move

- Liquidation move into the buying tail that found new buyers (new fuel)

- Open drive strategy from the cash open based on new month flows

Key Open Drive Strategy Takeaways

Nothing in trading is one-dimensional. Using one-dimensional pattern thinking does not lead to long-term consistency. It is the depth that we need to build in order to understand strategy selection. In this case, it is all about the reasoning that the market is positioned correctly for the faster momentum move, and in that case, we are choosing Open drive and opening flows to execute on our reasoning.

If you liked this article, you might check these videos as well:

- Open Drive Explained | Axia Futures

- The Open Drive Strategy Explained – Trade Strategies | Axia Futures

- How To Trade The Open Drive Strategy – Trade Strategies | Axia Futures

And if you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK