Lessons From Managing The Price Ladder Trade Introduction

In this blog post, we will review lessons from managing the price ladder trade. We will take three different styles of managing the trade using a price ladder. The first example will capture a trade triggered by news executed in multiple products, two other trades were triggered by a technical setup. We will introduce trades and then focus on the particular management style used during the trade. We will ask questions that should give you insight into particular points of the management style. If you are interested in price ladder trades example, don’t forget to check our previous post: Elite Trader Trades False Break Setup With 200 Lots.

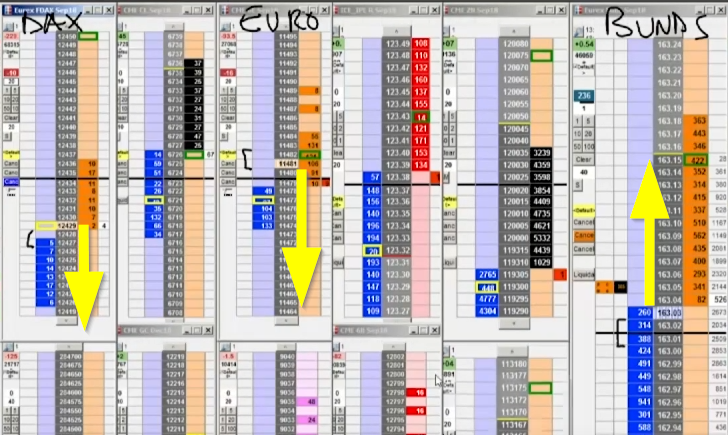

Price Ladder Trades

AXIA Elite Trader Trades a Trump Tweet

Theme: This live trading replay shows how an elite trader on the Axia Trading Floor executed multiple trades across three markets in response to a tweet by President Donald Trump on August 10th, 2018 at about 13.47 GMT+1. Adam walks us through an order flow analysis of this trader’s price ladder execution. Trump’s tweet relating to the Turkish crisis theme saw reactions in the Lira (weakening against the USD), acting as a gauge for flows into the Euro, Dax, and Bunds. The trader reacted to this by buying safe-haven Bunds and selling Dax and EURUSD futures.

With the lagging reaction in the Euro, having not moved as far as the Dax and Bund, the trader worked more size into his position, looking for a quick blip down. This hypothesis held while the Dax continued pushing its lows and the Bund held higher prices. When the Bund then failed to pop its high and the Lira continued to pull back, the trader recognized this fact and immediately sized down his trades.

Price ladder: recording starts at 5:27

Execution style: Aggressive, taking profits by laying down small clips

Questions:

- What correlations did this trader use to have a conviction in his Bund trade?

- How this trader managed the early squeeze that put him under pressure?

- What was the style of taking profits and managing risk?

How To Cut & Reverse When Heavy Selling Dries Up

Theme: In this trade example, we are looking at the Bund. Originally we wanted to sell and follow through with the lower prices but the moment the sellers really stepped in, something changed. Here are the clues that led us to cut and reverse the position from short to long based on the price ladder:

- heavy selling stopped the moment we touched the 166.30 – the first sign of a personality shift (we have turned the heavy selling into very little selling into the lows)

- we have absorption from the sell side, someone passively absorbing at 33 but no one is willing to hit the 32

- an attractive bid of 1000 teasing the sellers but nobody is willing to get closer to the bid, again signs of sellers not willing to hit lower prices

- when the absorption level fails at 33, that is the first crack in our plan to go short

- we start to hold above 33 and start to move up, then a little flick to test the 33 but again, no one selling below that point

Execution style: Patient, relying on the participants that are in control, keeping trade as long as buyers are in control

Price ladder: recording starts at 5:15

Questions:

- What was the general theme for sellers the moment we touched 166.30?

- How would you describe price ladder personality before and after we touched 166.30?

- What was the point to get long on the price ladder? Hint at 5:15.

Junior Trader Reviews Dax Trade On Cash Open | Axia Futures

Theme: In this trader training video Adam reviews his technical trade in the DAX just before the cash open which is 8 AM. He looks at high time frame moves on the daily chart with clear targets. Then he looks at the market profile weekly and daily before showing his execution on the price ladder. The other markets he looks at for correlation are the Yen, T-Note, Gold & Spoo. Adam ends off this video by looking at the 1-minute chart and where he executed his trade in the Dax.

Execution style: Semi-aggressive, willing to stand through larger short-term pullbacks while momentum keeps pushing price higher

Price ladder: recording starts at 14:53

Questions:

- What specific correlation did Adam lean on to have a conviction in the trade?

- Out of 5 lots, how many lots this trader used to get the trade going and why?

- What was the best practice to add additional size to the trade? Initiative lifting the offer of passive entries?

Let us know your answers under the videos. Thanks for reading.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Do you like what you have been reading? If you would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading again and until next time, trade well.

JK