How To Trade To Your Strengths Introduction

In this blog post, we will discuss how to trade to your strengths. How one can learn to identify and work on his strengths. How some weaknesses can become future strengths and what a trader needs to do to improve his trading. Trading is a game of observation. It is so hard to master because you have to combine a lot of moving parts and be patient with their integration. Sometimes our progress is limited by the way we work with our strengths. Many times we try to fix weaknesses completely missing the point that if we would have focused on our strengths, we could have 10X our progress. If you like this type of article, check our previous post The Fishermen where we explore learning via negativa à la Nassim Taleb.

This article is based on the video down below.

Why To Trade To Your Strengths

Focusing on your strengths is crucial. It is encoded in the statement already. You want to start from the position of strength, not weakness. Not just in trading, but in anything you do in life.

Imagine you are about to fight an amazing fighter. You are great at submission grappling techniques and have terrible kicking techniques. How would you feel in a fight against a fighter whose kicking technique is amazing and rules of the game dictate that only legs are allowed? No submission grappling allowed. Would you still compete? Yet we do this every day in our trading.

Part of the discovery as a trader is to explore all our strengths and weaknesses. Let’s say that is the period of the first 12 months of intensive training. In those 12 months, you should get exposed to as many things as possible. Those 12 months are all about observation. It is the time when you practice your art of observation, so in the next 12 months you can narrow down your focus.

This trader summarised why he wants to play to his strengths by the following:

- Improve performance -> become a better trader

- Learn more about ourselves

- Develop our skillset -> don’t be the jack of all trades

- Achieve potential

Questions To Ask To Trade Towards Your Strengths

Here is the list of questions you can constantly ask yourself to evaluate your strengths and weaknesses.

- Am I annotating my trading well enough so I can learn about my strengths and weaknesses?

- What are my strengths as a trader and how can I master them?

- What are my weaknesses that I wish to develop into future strengths?

- What are the weaknesses that are holding me back and should be phased out?

- What is one limited behavior holding me back and how can I change it?

You need to log and observe a lot first before you can identify what needs to be phased out. Be patient, and change techniques, but document what you see, feel, expect and do to the best of your abilities.

List Of Trading Strengths And Weaknesses

Here is an example from Prinesh about his trading strengths and weaknesses.

Strengths

- Cash opens

- Entering near the high or low of the session

- Entering at the start of bursts

- Positional (over hours)

- Strategic

Weaknesses (I wish to develop)

- Macro Trading Events

- Build up a position as conviction grows

- Adding on rotations

Weaknesses to phase out

- Pre-emptive breakouts near extremes

- Trading pullbacks inside the range

- Trading 11:00-13:00 and after 16:00 (London time)

Now go back to your charts, your trades, and your journals, and annotate categories of strengths and weaknesses. Stare into it until you distill 5 examples for each category.

How To Trade To Your Strengths Examples

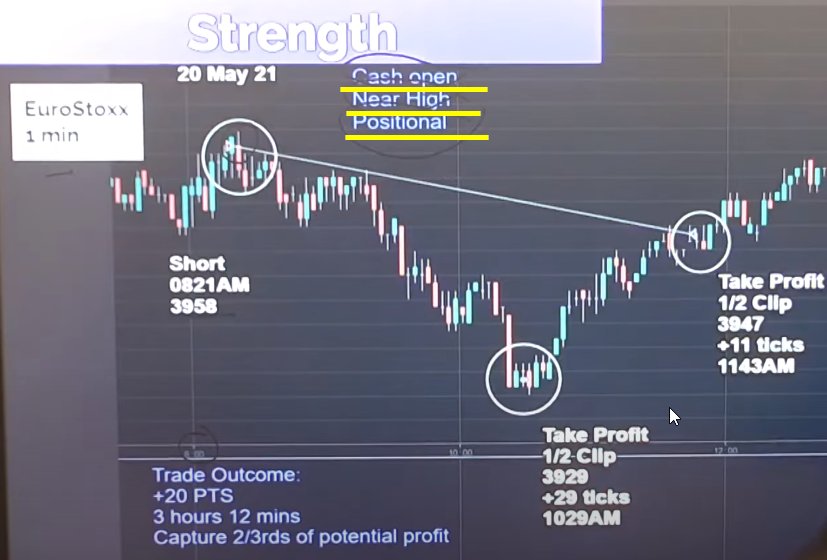

Let’s have a look at the strengths that Prinesh identified in the Eurostoxx example.

You can clearly see, that in this example, he was able to execute around cash open, near the high of the session, and took a positional trade. He has combined three of his strengths.

Now let’s zoom in on the opposite. This is the weakness that this trader is working on developing.

The biggest weakness Prinesh has identified is his current inability to act quickly and early. He needs to work on his preparation and understanding of these events so he can be confident and not hesitant when the news comes out.

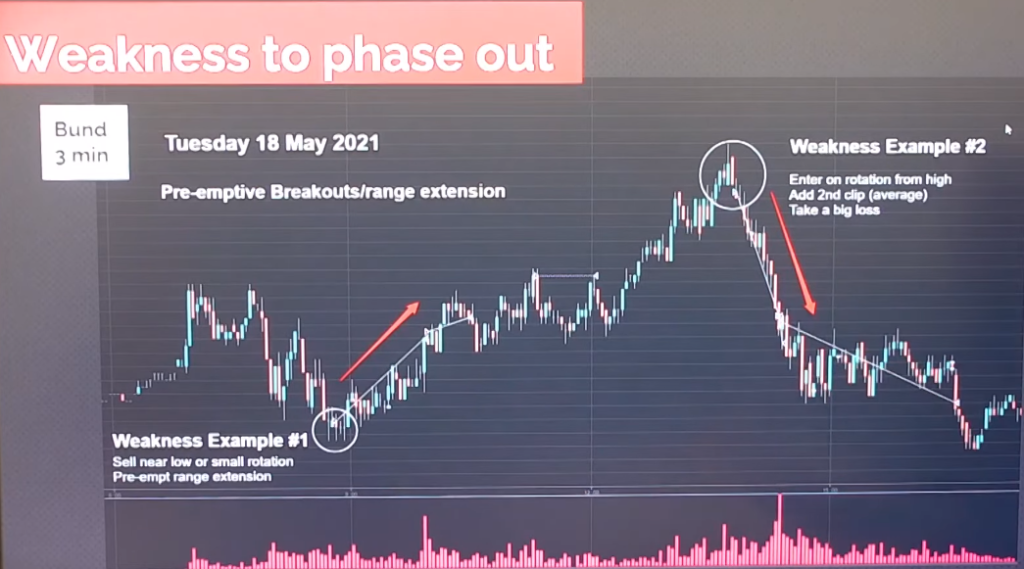

Last but not least, a weakness to phase out. This specific weakness is about pre-emptive entries into a breakout near the low of the day and entering near the high of the day into a supposed trend move.

If you are seeing similar behavior in your own trading, now you have a blueprint for what to do next.

Key Trading Takeaway

Remember

- strengths evolve over time

- market conditions can impact strengths

- easy to be obsessed with weakness at the expense of underplaying your strengths

Action points

- raise performance by focusing on strengths

- identify and develop certain weaknesses into strengths

- phase out other weaknesses that do not serve you

Thanks for reading. If you liked this type of content, you might check these videos as well:

- Junior Funded Trader 2020 Performance Review

- Lessons From My Biggest Trading Loss

- Trader Training: How Long Does it Take a Trader to Become Consistent and Profitable | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK