Scalping Reversal Strategy Of Trapped Market Participants Introduction

In this blog post, we will introduce the scalping reversal strategy of trapped market participants. This will be a scalping strategy where we will focus on the fast move-to-move type of target. This trading strategy in general should take no longer than a couple of minutes from initiation to exit. The basic premise of this strategy is the initiative that gets trapped and had to cover fast. We will use primarily the price ladder as our main tool for extracting the edge from the market. We will focus on two markets for this strategy (Oil and S&P 500) and combine the price action and the order-flow in the execution. If you like similar types of strategies, don’t forget to check our previous article Price Ladder And Orderflow Trading Tactics.

This article is based on the video down below.

Scalping Reversal Strategy

Scalping Reversal Strategy Mechanics

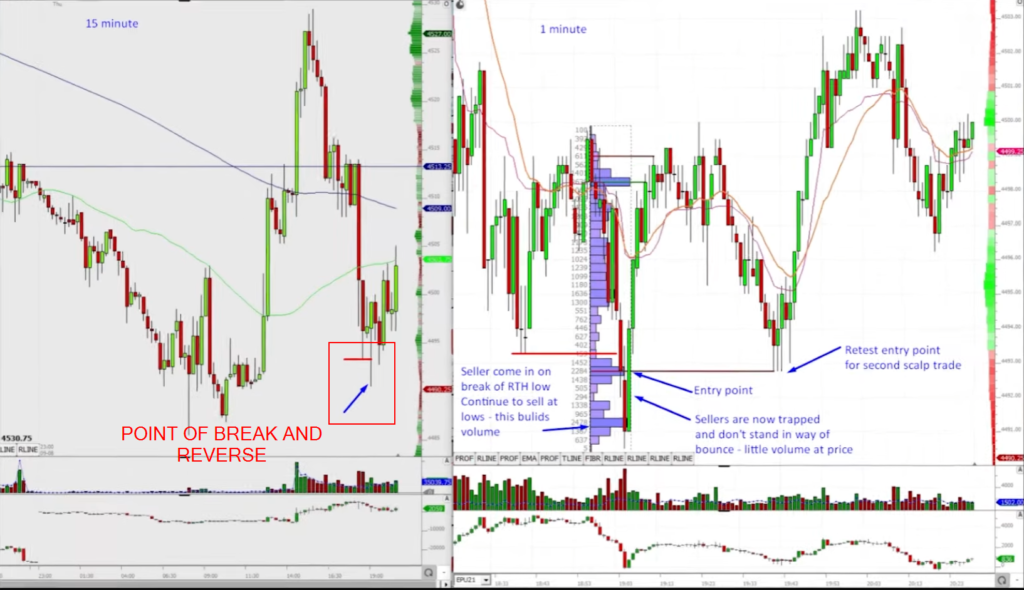

The idea of the strategy is simple: We are looking for trapped market participants. What do we mean by that? We are looking at the extreme or nearby extreme (can be local low/high or daily low/high), and we try to identify the HVN (high volume node) at the very low/high of the most recent move. In the trades below, we will look at the S&P500, which failed to follow through the previous low, and Oil, which left the HVN after the exhaustive move and reversed.

Trapped Sellers In S&P500

Let’s start with the S&P500 trade.

In the S&P500 trade, we are playing for a reversal long. We have identified a low that we would like to attack if sellers failed to follow through. From the simple price action on the chart, it would be much harder to judge, but we will use the price ladder for the perfect timing of our execution. We will be looking at the break, then focus on the volumes traded down below the break. Once the little HVN will be formed, we will monitor for any flick back up. We want to see after the flick the LVN zone left behind. That jump after sellers cant push any lower is what we want to see. These can be our trapped sellers. Our goal is not to take this to any outstanding targets. Rather, our target is the point of origin of this last swing leg and our stop will be placed just below the HVN formed at the lows. Watch this part of the video, where Richard explains in detail the order flow of the move and how it looks on the price ladder.

Trapped Sellers In Oil

In this particular example, we are looking for an exhaustion low that has been tested and failed following a similar logic as the S&P trade. Again, look for that HVN formed, that jump after where you can initiate your position and target the previous point of origin of the leg down. Again, don’t forget to watch the price ladder segment to understand in detail the price ladder dynamics of this trade. Here is a quick snippet from the price ladder. Do you see that LVN zone on the right side of the image below? Watch the video again and understand how the LVN was created.

In both of the instances above it is crucial to understand to pick the right extremes to play with. You must know and understand why you are picking this particular low to monitor for failure. Don’t pick any low or high, but add extra clues to maximize your trading edge. Have a clear process of how you identify these extremes for possible reversal and watch your risk.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK