Price Ladder And Orderflow Trading Tactics Introduction

In this post, we will break down three Instagram trading videos and highlight price ladder and order-flow trading tactics. From what to do when large orders appear on the bid, reading the size of the orders in order to get into the trade, to the personality shift prior to the breakout. If this price ladder action is something that you are interested in, don’t forget to check our previous post on price ladder management of the live Gold trade where our Junior trader Harry put on a large position in Gold.

This price ladder tactics article is based on the AXIA Instagram channel posts where we frequently share trading insights from the trading floor with the trading community.

If you are interested in videos like this, watch our full videos on a free two-week trial at https://www.AxiaFutures.com/

Price Ladder Trading Tactics Breakdown

All of the videos below share one component: the price ladder dynamics. Down below we will look at three different scenarios in which reading price ladder order flow gave you a trading edge.

How Large Order Can Help You Time The Exit

What we are seeing in the pound trade is that somebody sits on the bid with 980lots. Given the context that we have already dropped 100 ticks and we are well above daily ATR, this information from the price ladder can lead to several questions. The first question about large orders we should ask is if the order is genuine. The bigger it is, the further from the market, and the longer it is there, the higher chance it is genuine. If the market has traveled quite a distance already, a lot of traders might use this order as an area to exit their short-term positions. I personally like, if the order gets tested first and if the order is genuine and not taken immediately, I prefer to exit the position if it fits more or less my target. In our example, 114lot trades into large order and then bids. The other thing you could do, if you did not have your position on is to front-run this large order placing your limit just in front of the order. All in all, always consider the market’s previous trajectory and think, what might other traders seeing this order do here. Where does the market come from, at what level does this large order sits, and what is the likelihood the market will have the power to continue through the large order? Many times, when the large orders are taken fully but can’t go any further, it is even a stronger sign, that market has found a temporary extreme.

Personality Shift Prior To The Breakout

In this breakout example, we are looking at the price ladder of the Euro. Euro has been creating a nice base and there is a chance for a breakout to the upside. By watching the price ladder, you can see, that the moment we got close to the breakout level, the market starts to hold bids pretty steadily. Every time market offers, the bid reloads. The bid is continuously stepping back in with no stepping back. This is a sign of buyers, holding their ground. So what is the personality shift? Personality shift is that change, the moment when passive holders of the bid become initiative buyers. In the video, it is clearly visible through the flick up. There is a flick, fast move, increased volume, and energy that leads to a successful breakout. That flick was your chance to get your trade going and add passively at key areas.

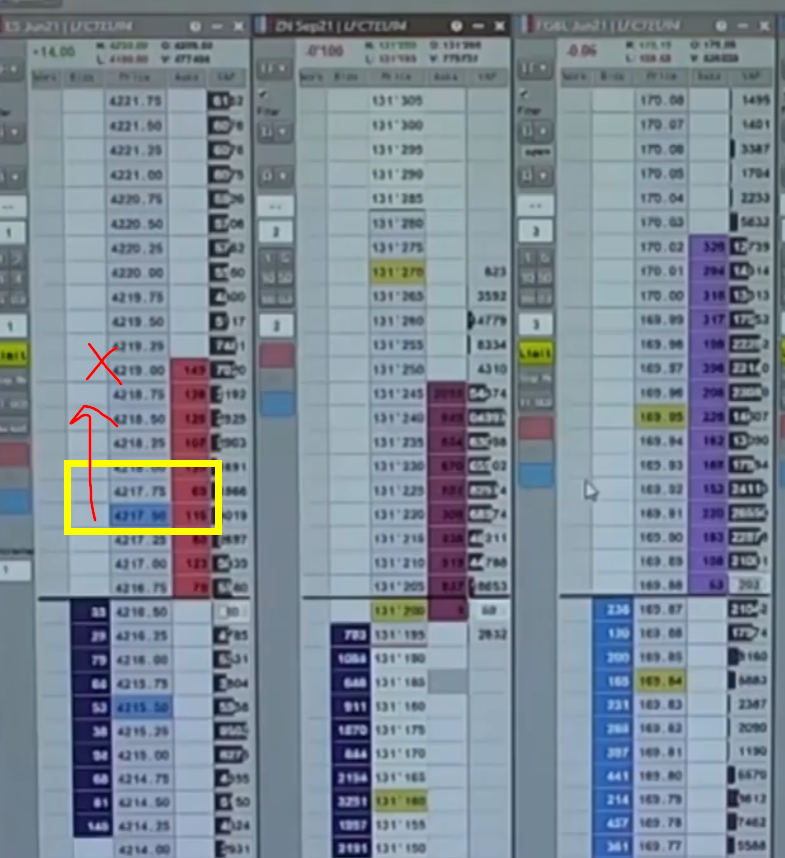

Order Size That Can’t Lift The Offer

In our last example, we will focus on the execution in the Spoo (ES). It is critical to pay attention to the actual size lifting the offer. Why? With the bearish trade idea, this trader wanted to put on, he was watching for the weakness of buyers. What is the size, the buyers are trying to lift the offer? The longer they try to lift the offer on light size, the higher the chance that sellers will step in. Light size = lack of initiative. From there it is only a matter of time, you will become more initiative. Watch his analysis of the order flow here.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK