How To Trade The Squeeze Pattern In S&P500 Introduction

In this blog post, we will look at how to trade the squeeze pattern in S&P500. How this trader has identified a vulnerability in the market and exploited that vulnerability through observing price action around the US Cash Open. How combining price action patterns, footprint, market profile, and price ladder activity gave this trader conviction to pursue his trade. If this toolkit is something you are interested in, check our previous article about “Trading Initial Balance Break Using Market Profile” and continue reading.

This blog post is based on the content from the video down below.

Squeeze Pattern Trading Context

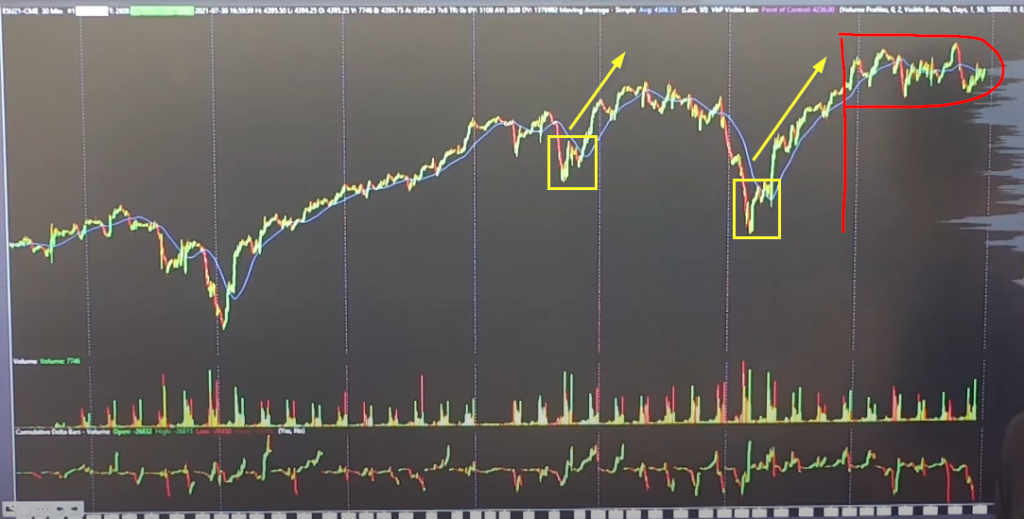

Starting from the bigger picture, this trader has identified that the market has a tendency to put in reversals by squeezing the positioning (see yellow boxes below). This was the reoccurring trade. We are in the uptrend market and pressure is clearly to the upside. Buyers are in control and have formed lately the P shape profile. This clue adds a conviction to the trader’s willingness to execute the squeeze pattern.

As we zoom in on S&P500, we can see that market is truly well bid. We are leading into the month-end and we are leaving behind poor lows unexploited. This is yet another clue, that buyers are in control. With P profile having no excess from the top side, this can be an attractive magnet for already dominant buyers.

Given all the clues this trader has collected, the trade idea is this:

Play open drive squeeze through the Globex positioning block.

Squeeze Pattern Trading Execution

Given the bullish clues this trader has formed he is ready for the cash open action. As you watch his price ladder recording, you can notice several characteristics that stood out on the tape.

First, the offer-and -absorb action in the first seconds of the auction pushed immediately the market higher. It is the first sign, that market starts with a more persistent bid. As the market approaches the Globex block, the idea is that the market should start to squeeze higher above that block. Right at the edge of the Globex block, we can see increased size pressure and a little bit of backing off which is what we have expected. Given the month-end, we can see some large orders aggressively hitting the market producing temporary fast wash which is what happened exactly here. As the trader describes, that surprised him a bit first but gave him a clue for future trade direction. Given his bullish thesis, this washy price action when the market does not auction each price but simply eats many prices is actually a good chance to get long, not to get scared and be hesitant. The market immediately moved back into new highs again. Then market offered again the same opportunity of washy drop that absorbed and started to bid again higher. The opportunity was repeated one more time. From that moment, the market steadily (but rather slowly) moved in a two-way auction higher. Not in a straight line, but rather continuously seeking liquidity higher.

Key Takeaways From Trading The Squeeze Pattern

Given all the information, these are the lessons that this trader has highlighted:

- Fast offers with no auction are likely to be retraced (note also month-end) – remember, that washy action we have described, that was your chance to add into the up-trending market

- Question: “Do these big sell orders in any way invalidate my trade idea?” Answer: ” No. So I shouldn’t let them be an excuse to lighten up my position”

- A squeeze should hunt for liquidity so don’t back away when finds it – not expecting a straight line move is key. The rhythm is more like seek liquidity higher, absorb, offer, absorb, bid. Repeat.

Thanks for reading.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Do you like what you have been reading? If you would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading again and until next time, trade well.

JK