The strategy to trade the Federal Reserve decision this week could be very similar to that of the ECB decision last week. Expectations are limited and the meeting could be treated as a fact finding mission for traders wanting to better gauge when the Fed will consider Tapering of their recent huge asset purchases. Focus will be on the Q&A that follows Chairman Powell’s press conference with the key question/talking point likely being: what is meant by ‘substantial progress’?

Why Does ‘Substantial Progress’ Matter?

The reference to substantial progress was brought into the Federal Reserve’s statement last month as a qualifier for how long how long their assets purchases would run for and consequently the achievement of substantial progress will initiate the taper process.

“Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals”

The 2 key questions therefore are:

- How will we know when substantial progress has been made?

- Once substantial progress has been made how soon after will asset purchases be tapered?

How to Trade Substantial Progress?

Substantial Progress is the focal point for this decision and as with every Central Bank decision one needs to have a process for trading the focal point and other potential change. If we break up a typical central bank decision into it component features many follow a similar pattern of release and the way to trade each part of the release differs. The components are:

- Policy changes – typically a press release of decisions taken and any changes to policy or repeat of the current policy

- Statement – further explanation of reasoning behind policy decisions – guidance on futures potential changes

- Q&A – a chance to find out more information – also chance for the Central Bank to hint further without explicitly committing to a change by putting it in the statement

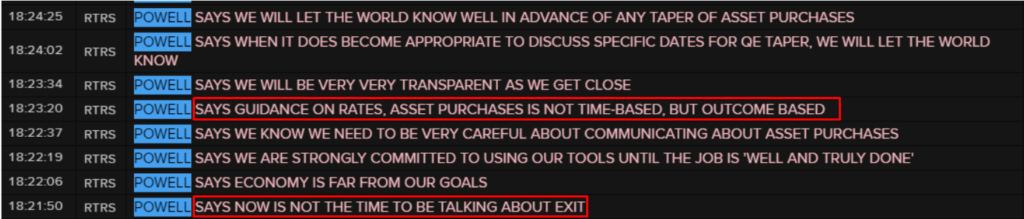

With expectations low of any change in policy or statement you need a process to quickly ascertain the meaning of a question’s answer and how this will affect markets. So, simplify the what the answer relates to – questions about progress ultimately are trying to answer a simple question – when will taper start? Market expectations are that taper will not begin this year – Powell made this clear in a recent speech (key points are highlighted below). Any suggestion that Substantial Progress could be made/achieved this year should bring forward expectation of taper provides a trade opportunity.

Which Markets to Trade on The Federal Reserve Decision?

Market selection is always key on a Central Bank decision and picking a market that will not only be affected by the change or hint in policy but has the scope to more technically is key – this is why a market may over react in one direction but under achieve expectations for a move in another. So market selection is down to deciding whether a certain market will move better on a hawkish (less stimulus) or dovish (more stimulus) comment. Take for example T-Note (below) this is just one of many potential markets to trade – your preparation needs to consider how it could trade on a move down back against the recent steady move higher (potential sweep of range 137’02-136’21-17) and how will it react at key resistance 137’20? What happens if it break 137’20

Plan Your Trade – Trade Your Plan

Whenever you trade a Central Bank decision and when you are learning to trade Central Banks the most important thing is to have a clear plan of what you are looking for and what you will trade if one of your scenarios plays out. Without this you will be left jumping between markets over the decision and perhaps worse, not being able to see where you went wrong because you have no plan to compare your actions to. Every Central Bank decision can potentially be a chance to make substantial progress in you own, not just form a P+L point of few but from a leaning one too.

Richard