The European Central Bank (ECB) is soon to make its latest decision on monetary policy. This will be keenly watched at Axia Futures by the Elite Traders who know how big an opportunity a central bank decision can be, as well as by our students on the Career Trading Course, learning to trade central banks for the first time. While trading opportunities may be limited after the ECB already increased its significant stimulus back in June, the level of preparation for this event will not diminish. Rather, it will be the trading strategies that will change.

Central Bank Trading Strategies

The first and most consistent Central Bank trading opportunity is a scenario based trade: The ECB could change some of its policy and create movement in various markets. So what could they do? And more importantly where is the trade in it?

The majority of research is focused on the possibility of the ECB increasing it’s tiering multiplier. The aim of this is to alleviate the costs to banks of placing money at the ECB and receiving a deposit rate of interest of -0.50% (meaning that it costs them to put money at the ECB). Currently European banks must hold a certain amount of their assets at the the ECB, anything above this and they receive the deposit rate.

With all the extra money created since the outbreak of Covid-19, banks now have more spare cash on hand and will incur costs when depositing it. A tiering multiplier was created in Autumn 2019 and is applied, meaning 6x the required amount can be deposited and a bank will not have to pay the punitive -0.5% interest. The additional stimulus due to Covid-19 now means banks have even more money and are being affected again. Therefore, there are calls for the multiplier to be increased to 10x or 12x.

ECB Trading Scenarios

So where is the trade opportunity? An increase will be good for banks and creates an obvious equity market trade. Your scenarios could be:

- Increase to 10x or 12x would be in line with expectation and create a potentially short lived move.

- No increase – because expectations are for an increase, this would be a disappointment and offer a possible short in equities.

- Larger than 12x would be a significant change and should theoretically keep equity markets moving higher.

Having a clear set of scenarios and a plan as to how you will execute them is one of the most important parts when learning to trade Central Bank announcements. Not only does a clear plan reduce hesitation in your interpretation if one of your scenarios play out, but it also gives you a reference against which to compare your performance to your expectations. Today’s potential scenarios are covered in the Axia Futures Central Bank briefing in our live trading floor stream available to members.

Trading Strategies If The ECB Does Nothing

Bank Trading Strategies are still available even if no policy change occur. Once the no-change decision has passed, markets will then present structural plays: trading strategies based on positioning and where markets indicate they want to go. Markets typically stabilise before a central bank decision as participants wait on the possibility of change before adjusting or taking new positions. As such, pent up volume is ready to act and thereby creates heightened trading opportunities.

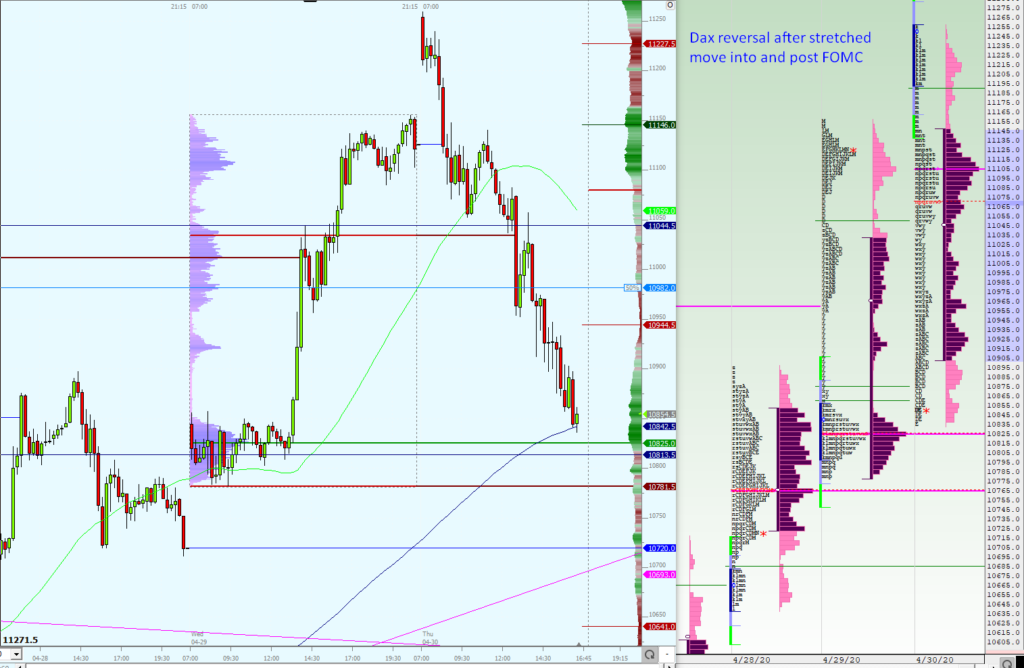

Take for example the Dax over the April ECB decisions below – whilst the decision was broadly in line with expectations, there was still a large trading opportunity: Because the market ran higher the day before yet didn’t shift value on the market profile, it can more easily reverse (an elastic band trade), as when nothing indicates a reason to continue higher, the buyers from the previous day need to exit their positions.

Similar trading strategies may well be available today. The important thing is to have a clear idea where your traded market can potentially move and an awareness of how that expectation aligns with many other participants in the market and the moves that can quickly develop and go further than expected.

Makes sure you have a plan to trade any central bank event and if you want to learn more about how plans can be formulated, check out our Central Banks Trading Strategies Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 8 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.

Richard