Expectations are rising for the ECB (European Central Bank) to change its monetary policy, however, the expectations are rising for action to be taken in December. This does not mean that this month’s decision will be a non-event – To avert a surprise, or to prevent ‘seeming behind the curve,’ The ECB needs to guide the market as to what it may do in December, if any thing at all.

Why Might The ECB Change Its Monetary Policy?

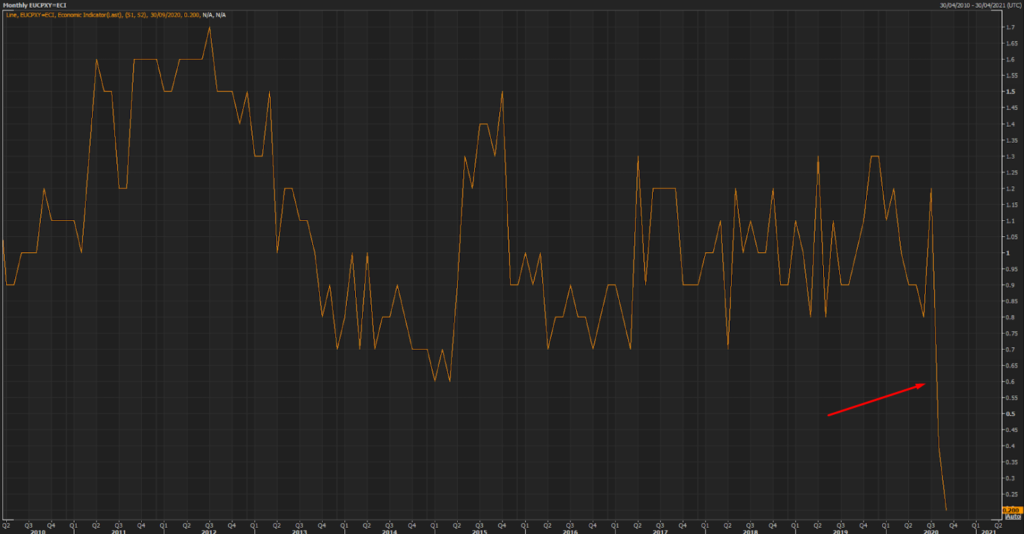

There are 2 main reasons for changing policy: Disappointing data, particularly inflation, and the potential impact of the Covid-19 second wave. Inflation has taken a downturn in recent months and is now just under the ECB’s projection from September (0.3%) at 0.2% as the ECB has long struggled to get inflation to their target of “close to but below 2%” the recent drop, even though a result of the pandemic, could be a reason act sooner rather than later.

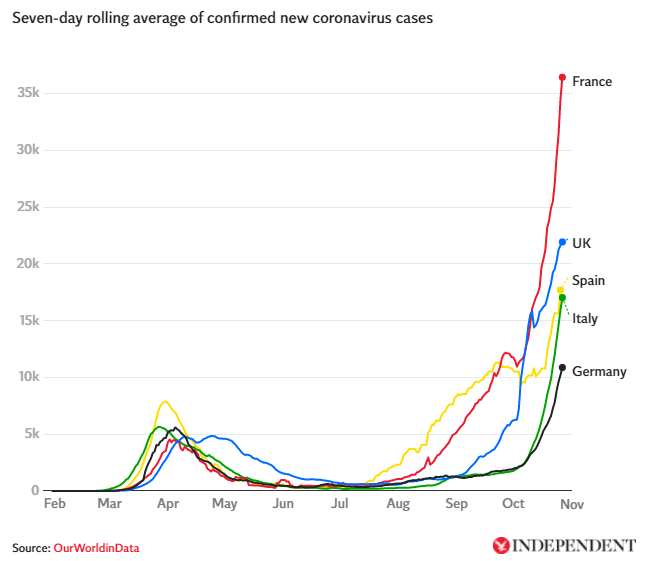

Lock-downs are beginning again across Europe to combat the recent surge in cases with France and Germany announcing further lock-downs of varying severity the day before the ECB decisions. If the economic impact is felt in the same way as in March will be needed. Here the ECB has a balancing act of waiting to see if the EU fiscal response, which is not expected until early next year, can alleviate the issue or whether they will have to preemptively step in with changes to current policy or new measures, Lagarde recently suggested that “options in our toolbox have not been exhausted”

What Are The Expected Changes in Policy?

The ECB has multiple options in how it can change policy, some more dramatic – changing their PEPP program and some more nuanced – changing the tiering multiplier. These potential change are largely expected to be kept until December.

- Increase the PEPP by €500bn from the present €1,350bn level. This would be the most dramatic policy change by increasing money being printed and thereby attempting to avert the problem of falling inflation and preempting the need for more funds in the economy to prevent bank lending seizing up

- Extending the duration of PEPP to end 2021 from June 2021. A more subtle approach that keeps accommodation and ensure the end is far away, a more extreme version could be to not set and end date on PEPP at all as suggested by Villeroy

- Changing some of the criteria in the TLTRO III to make it more attractive to banks to borrow form the ECB – potentially extending the current special rebate until end of year.

- Increasing the tiering multiplier from 6x to perhaps 10 or 12x as was expected back in July. This will help banks profitability but do little to avert the Covid or inflation issues.

ECB Trading Strategy

The ECB rarely changes policy outside of their quarterly meeting, barring exception circumstances, which include staff projection (the last time they did saw PELTROs in April 2020). Therefore signalling the change in policy in December will be the focus, meaning that the statement delivered by Lagarde will where most potential trades lie. Signalling can come in and explicit or implicit form, the expected explicit form of communication would be to use the phrase “task relevant committees” which translates as “we will very likely act at the next meeting.” This phrase was used multiple times by Mario Draghi (in July 2019 before cutting rates and restarting QE the following month) but importantly has not yet been used in a statement by Christine Lagarde. Therefore a different suggestion and variant of “reassessing policy at the next meeting” may well be used instead. The (semi)explicit guidance will send the clearest dovish message, a more subtle approach could be to change language in the opening paragraph of the statement regarding the current situation; the first sentence The incoming data since our last monetary policy meeting in July suggest a strong rebound in activity broadly in line with previous expectations, although the level of activity remains well below the levels prevailing before the coronavirus (COVID-19) pandemic. could be adapted to suggest the rebound is not so strong, thereby implying the need for policy change.

Many of our Axia Traders will be considering the possibility of no change – this is because all the focus seems to be skewed towards some kind of stimulative policy of signalling of one, meaning everyone is looking in the same direction, perhaps a slower burning trade strategy will be need here as throughout the press conference signalling could happen but if no change is coming markets could well be disappointed particularly in light of the recent, Covid induced sell off in equity markets.

As always make sure you have a plan to trade any central bank event and don’t dismiss the importance of no action. If you want to learn more about how plans can be formulated, check out our Central Banks Trading Strategies Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 6 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.

Richard