Getting On A Liquidation Move Using Price Ladder Introduction

In this post, we will be discussing how the price ladder can help us getting on a liquidation move and sticking with the trade. In order to understand this type of a move, it is important to understand what we mean by “liquidation”. In this context, we are talking about one side, that has been trying to move the market in one direction, many times in the direction of the most recent trade, and a lot of positioning has been built towards this direction. This usually leads towards the creation of a range/balance type of a structure. The liquidation move is the move when all one-sided positioning needs to get unwinded either by running for stops or triggering the stops in the opposite direction. In its essence, this can be treated as a breakout trade with a deeper contextual understanding of why might the breakout actually occurred: because of the “liquidation”.

Checkout the video down below for full detail of this article.

Trading Context

We will be primarily looking at the setup that occurred in the DAX and STOXX (EUROSTOXX) markets. As you can see in the picture below, the most recent trend was down. After the down move, a range was formed and the market has positioned itself towards the next directional move. At first, the market did not provide follow-through to the downside and moved back to the range. This is the first clue, that sellers are not strong enough to push the market lower. This might imply that as soon as we start trading higher out of the range, this might trigger a larger liquidation type of move. Let’s have a look at how we could have executed the trade and what options we had to get on the move higher.

Trading Execution Using Price Ladder

Zooming In On The Breakout Area

Zooming in, we will be primarily looking at the breakout in the DAX but we will be monitoring STOXX as well. As the market will be breaking out, the key question we will need to answer is how to get in the move higher. Key areas to watch are 77 in STOXX and 38 in DAX. Let’s have a look at the execution and options we will have in the DAX.

Price Ladder Execution

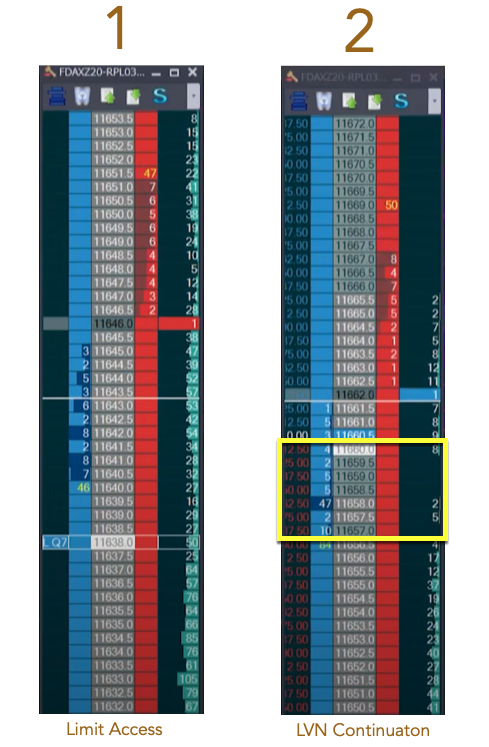

Down below we can see the price ladder for the DAX. As we are approaching the key level for a break, the rotations up and down look good. As we are breaking through 38, the steady rotations are presenting us with a first option on how to access this market. That is by placing our limit order at 38 and waiting for a rotation to come back to fill us. Unfortunately in this case market does not provide us a chance to get back on the move, leaving the first LVN zone behind us. If this was your only option to get on the move, you might get frustrated and angry from missing the entire move. If you had more access strategies (like the one we are using in our price ladder course), you could have been patient and observe the market further. As the market progressed higher, STOXX also confirming the move higher, DAX has created another push and created something that we call LVN (Low Volume Node) Continuation type of access (2, yellow square down below). The idea behind this type of access is that market should not get back and fill the LVN zone. Your risk is clearly defined below the LVN zone. As the LVN zone has been created, we can also see 40lots chasing the market that can give us an additional bit of conviction to get aggressively on this move.

As the DAX moves higher, we are looking for the target at the single prints. We are also looking for that acceleration into those single prints that will truly indicate that at least temporarily the move is over. At the end of this move you are really looking for that increase in speed, that last jump up that signals the rush for the exit. That is the time for you to take a profit. If you have not watched the price ladder movement, it starts here and I recommend you to watch it to get a full picture of what was described above.

Main Trading Takeaway

The highlight of this post and a video was a way how you could get in the move in the DAX if the market did not fill you on the first opportunity. That LVN Continuation type of access was your second chance to get back on to the move. Many times we are left behind with a great idea complaining, that we just could not access the trade. This is a great opportunity to expand your future options and most importantly: If you had a good idea, but you have missed your access or the market did not provide you the access you have expected, ask yourself if there was a different way how you could get on to the trade and improve your learning framework. Don’t create excuses, try to understand how to improve your game next time you will see a pattern you like.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- Trading S&P Long Liquidation Strategy

- The Short Squeeze & Long Liquidation Explained

- Liquidation vs Trend Day

Thanks for reading and until next time, trade well.

JK