Best Trading Setups For Trend Day And Liquidation Day Introduction

In today’s article, we will focus on the best trading setups for trend day and liquidation day. Each day in the market offers us a unique structure that reflects market participation. Understanding the participation on the day gives us great insight into what might happen next. We will be looking at the difference between trend day and liquidation day using price action and market profile and design strategies accordingly. Both days have their own set of characteristics such as when the move starts, what type of participants are driving the move, and what the move should and shouldn’t do in order to be a liquidation or a trend day move. All these clues can position us well into the next move that might happen within the given structure. If you are interested in a market profile, don’t forget to check our previous post Trading Clues In Market Profile Structures

This post is based on the video down below.

Trading Setups For Trend Day And Liquidation Day

Introduction

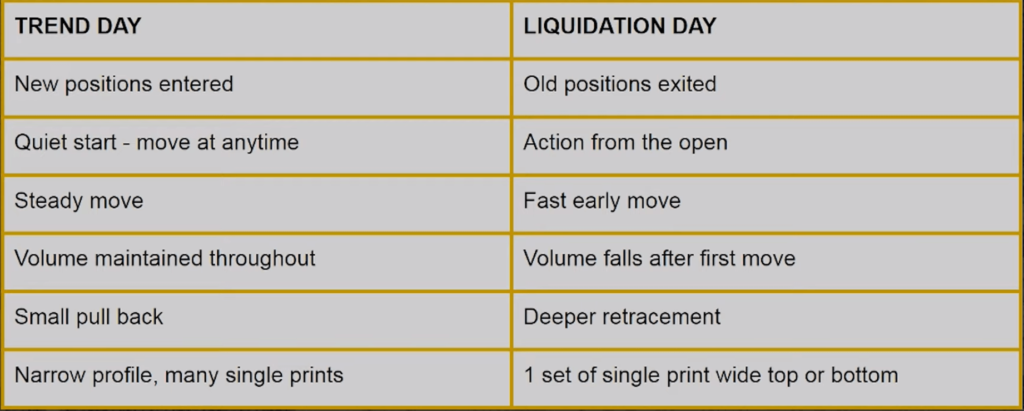

According to the market profile theory, every daily structure can be categorized into a different day type. In this specific example, we will focus on two different day types that have very unique characteristics. Distinguishing these characteristics can lead to strategies that you can include in your own playbook.

Looking at the table down below, the first main difference between the liquidation day and trend day is the market participation. In the case of trend day, mainly new positions are driving the move. In case of the liquidation day, it is the old positions exiting. Typically this creates a large impulsive move early when it comes down to the liquidation move. With trend day, the move has generally a quiet start and moves steadily throughout the day. Many traders lose their money on trend days because they do not recognize it is a trend day and they try to fade it. Rules to spot the difference between liquidation move and trend day need to be implemented to prevent these losses.

Apart from the steady move maintaining volume throughout the day, the key distinguishing factor for a trend day is that it leaves single prints behind and pullbacks that are generally small. Adding this rule to your checklist can give you a hint that maybe today is not the best day to fade the market.

Let’s have a look at a couple of trading examples and identify what clues could give an early warning of what day type you are dealing with.

Trading Examples Of Trend Day vs Liquidation Day

Liquidation Trading Strategy

Starting with the Bund, we can clearly see that the moment we broke below the blue rectangle low, the market offered hard. This offer is aggressive, a lot of accumulated longs have to exit their positions. At this stage, we do not know yet if we are dealing with the liquidation day or a trend day, but given the large early move and structure above us, we have a first clue that we are dealing with the liquidation move.

Zooming in, what happens next is that the next pullback is not shallow. The next pullback takes the previous support turned resistance and reverses creating a deeper pullback. Plus, the next leg down after a deeper pullback happens on a low volume. This is our indication that trend day is most likely not in play. Connecting the dots between the large early move and the inability of the market to maintain single prints, tells us, that we are dealing with liquidation day. What would be the best strategy on a day like this?

- a) you can play for the failure of the bottom of the move – play the double bottom

- b) you can wait for a deeper retracement and play a fade once the short-term trend breaks with a clear target for a continuation to the previous lows and exit there

Trend Trading Strategy

Given the clues we have learned, we can identify a couple of characteristics that this move in Bund has. The move starts steadily but offers us early on with one key clue:

staircase structure

This staircase structure is about the way how previous resistance turns next into the next support. It is not enough to say, “yes, this is a trend day” but gives us an early warning.

Now, as the market makes a steady move higher, the volume builds, and single prints are left behind. Now we are onto something. First, we know we should not fade this move. Second, we can use the shallow pullbacks and staircase to design our trading strategy:

- a) fade single prints that start to hold

- b) fade previous resistances that turned into support

Remember that you need to stack up several clues together to get a sense of what type of move you are dealing with. Then select the appropriate strategy that fits this day type.

If you want to learn how we trade the markets using day types like this, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

Thanks for reading.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Do you like what you have been reading? If you would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s Intensive High-Performance Trading Course.

Thanks for reading again and until next time, trade well.

JK