Steady Continuation Drift Breakout Trade Introduction

Not every breakout trade is accompanied by the pickup in velocity and in this blog post, we will focus exactly on this type of trade: on a steady continuation drift breakout trade. Understanding the type of day you are dealing with and the product you are trading can set the right expectations for you to hold on to your trade even when the market is not moving with the highest degree of momentum. This is important in building your expectation for the trade. In case you are interested in these types of trades, check out one of our other videos in regards to the breakout trade topic.

To fully understand what we will be talking about, I recommend you to watch the brief video down below.

Understanding Expectations To Hold Onto A Trade

At the beginning of the article, we have mentioned that it is important to understand the product you trade and how it usually behaves during the breakout. For example, one can have totally different expectations in regards to the breakout in Gold in comparison to the breakout in Bund. One market is thin, much more volatile, the other is thick and less volatile. This can also imply how the breakout is formed, how much time is needed for the breakout to happen, and its confirmation. In this article, we will be dealing with the German Bund market, which is in general a thicker market that is less prone to aggressive breakouts.

Context

Before we got to the location of the breakout, let’s talk a little bit about the context. The market sold-off from the open with the open drive move. Then we have slowly consolidated back and returned to the point from which the move initially started with the open drive move. That is our location. Now as we will go through our breakout location, you will understand that the pace is not dramatically picking up. That is something, that can under the different products and different conditions, scare you off. As a rule of thumb, context apart, these are the basics we want to see when a breakout occurs:

- good location where the market has a high probability to turn

- pickup in the momentum, with candles ranges expanding through our breakout location

- pickup in volume during the breakout

- delta picking up in the direction of the breakout

Now let’s have a look at the trading clues we have seen on a price ladder that can give us a little bit of confidence to stay with the move.

Price Ladder

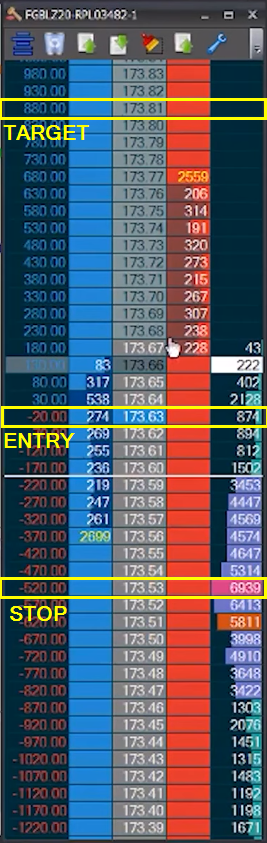

If you re-watch the part of the video where the market breaks the 63, you will notice a couple of trading nuances. First of all, as we are starting to get through 63, we can see elements of strength from the buyers, because selling is being absorbed by buyers. That is our first clue. Also, you can notice that there is not a massive sign, that the buyers would be very aggressive lifting the offers, but they are ok to passively absorb the selling. Bids size of the book is average, with no unusual strength. As we start to move through 63, 600 and 400 lots appeared on the offer. The moment, we trade into it, only 275 lots gets traded. This is another clue for us, that although we are not seeing aggressive size lifting the offer, the steady grind slowly lifts each offer. Now our target is in the 80’s zone and our stop just at the previous HVN (High Volume Node). As we slowly grind through 63, we need to understand that this move might be the type of steady continuation drift type of a move higher. As we go through higher, this move took overall more than an hour to get to our target. Not having the right expectations for the move, could easily get us out by thinking, “no, this is too slow, I am going out for a scratch or small winner”. Self-talk that might be helpful at other times, would prevent you from holding this trade all the way up to your target.

Summary

Having the right expectation for the product you trade and type of the day you can expect, can make or break your trade. Many times we are faced with doubts that the market is “just not moving the right way”. If this question emerges, we should use all possible clues to stress test our doubts and ask ourselves if the correct expectations were set in the first place. Setting the correct expectations and correct line of questioning during your trades can make a difference between losing and profitable trade. If you want to improve that part of your skill, check our courses down below where we teach skills like this.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Thanks for reading and until next time, trade well.

JK