How To Trade The Overnight Positioning Introduction

In this blog post, we will discuss how to trade the overnight positioning. Overnight positioning is something we should all consider in our morning analysis. Our goal is to understand, where the overnight market participants took the price in relation to yesterday’s close and yesterday’s value and how did they auction that activity. It is all about the intention of smaller timeframe participants that don’t have deep pockets to hold strong opposing flows when the European or US cash session opens. Let’s have a look at four examples where the character of the positioning played an important role during the open.

This post is based on the video down below.

What Is The Overnight Positioning

When we are referencing the overnight positioning, we are talking about market participants that decided to do their business during the Asian session and European session until the pit session or also called the cash session opens at 1500 CET. The Asian session can be considered the weakest in terms of volume participating in the price discovery. This means, that anyone who has a notable business to do, will most likely choose the pit session, therefore, the overnight session is more about short-term participants, one can even say slightly weaker hands.

During our analysis, we should focus on these clues from the overnight session:

- where are we in relation to yesterday’s value and close?

- what is the overnight range? Are we expanding or contracting?

- who is winning the overnight positioning? Buyers or Sellers?

- where are weak areas that can be attacked once the pit session opens

Sometimes we use the term “overnight inventory” referencing either 100% net long or 100% net short. This statement is all about where the overnight value and time have been built in relation to the previous day’s close. If we closed yesterday and keep on rallying during the overnight session, we are 100% net long. If we closed yesterday and keep on offering during the overnight session, we are 100% net short.

Now let’s have a look at four examples and how we could profit from these four opportunities.

Trade Examples Of Overnight Positioning

The Oil Positioning Trades

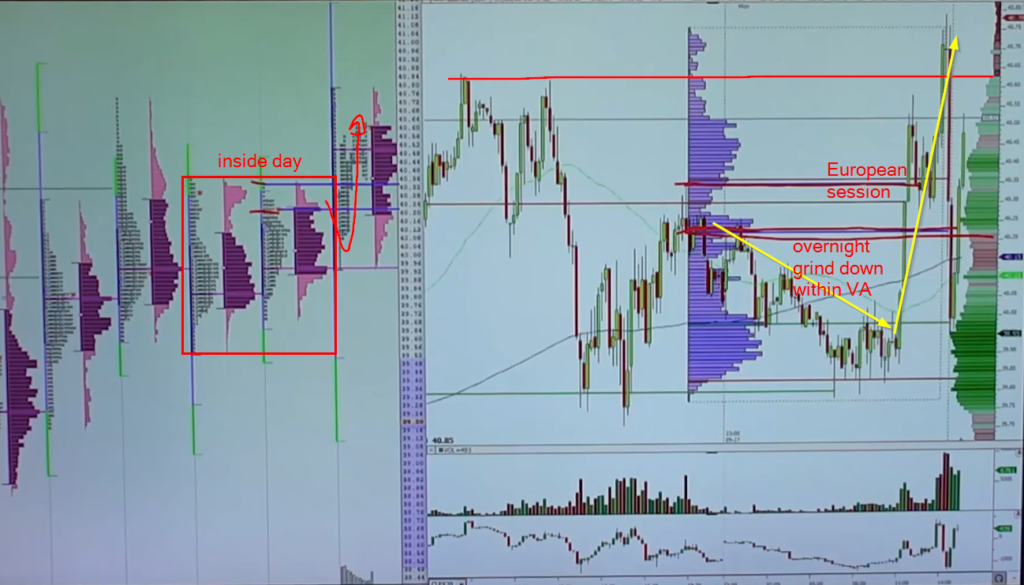

In the oil trade below we can see that:

- overnight positioning is net short

- with overnight grind down (sellers are in control)

- during the Asian session, we are within yesterday’s VA and range

- when the European session opens, we bid higher taking the Asian highs

Now, with a pit session open, we are taking yesterday’s high BUT the fresh flows are unable to hold those highs and follow through – this is a clue that possibly the overnight positioning liquidation (the net long liquidation) will take place.

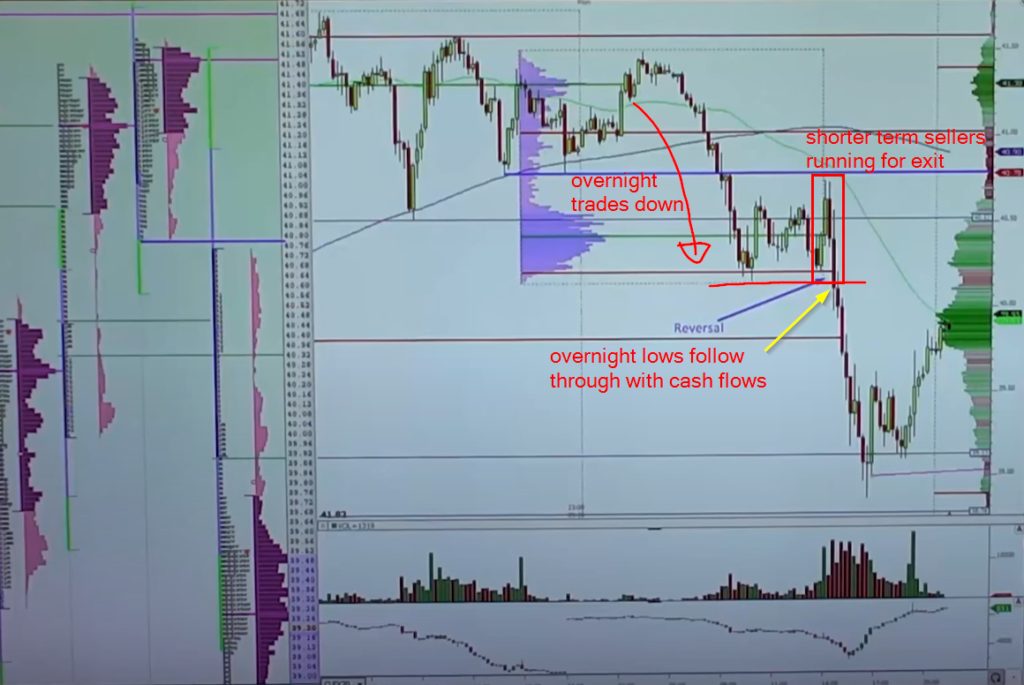

Now here is the different Oil example, but this time we are looking at:

- overnight positioning is net short

- we have balanced after the initial leg

- anyone who was short overnight feared the pit opening flows that started to bid and the market attempted to close the overnight gap but failed (weak hands that went short had to cover)

- after the gap close failed, the market offered again through the overnight low, this time with the force of the pit sellers

After the market broke the overnight low, it created the second leg of an equal distance to the first leg.

Now what are the lessons we can take away from these two Oil trades:

- the overnight low and high are very important levels to watch

- understanding the positioning: net short, net long, or neutral gives us a clue, about who might have to run for exit if the follow-through does not come with pit session opening

- in general, with pit session opening, we can either have: a continuation move (the follow-through move) of the overnight positioning or the reversal move of the overnight positioning

Let’s have a look at two more examples, but this time, try to identify the clues yourself.

The Dax and Stoxx Overnight Positioning

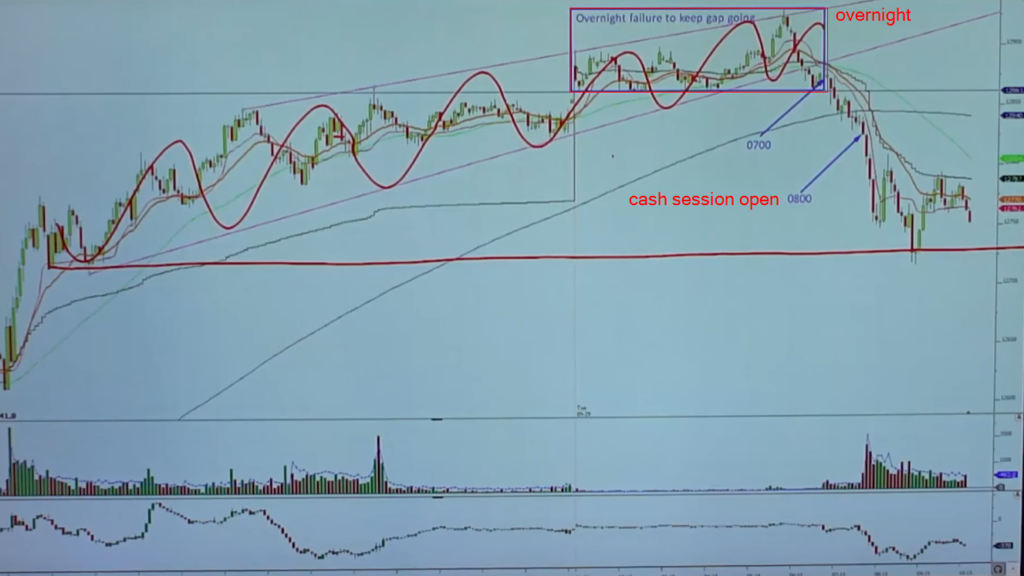

Here is the chart of the DAX:

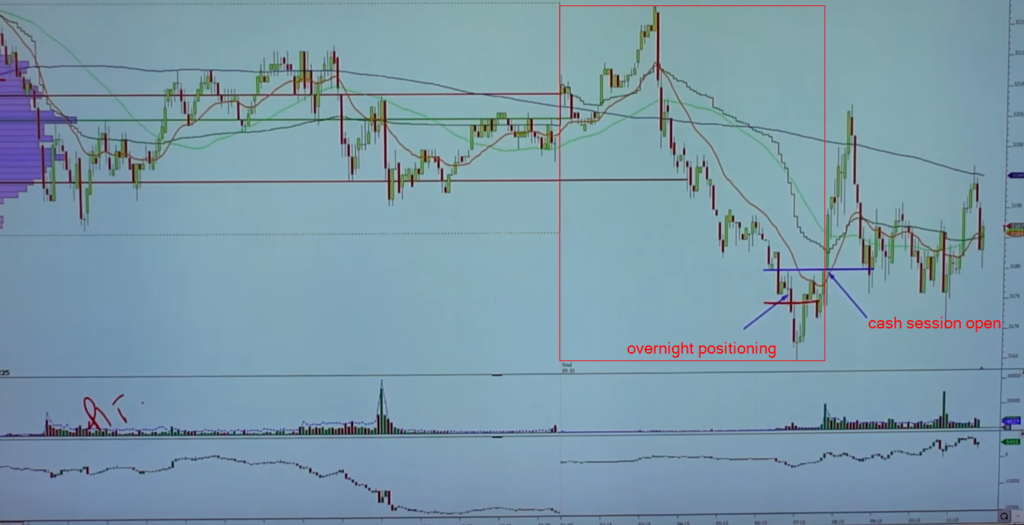

And here is the chart of Stoxx:

Now given the information at the beginning of this post, try to answer these questions:

- what is the overnight net long/short status?

- where are we in relation to yesterday’s range and VA?

- what happened when the pit/cash session opened and how did the overnight positioning react?

Leave us your comments under the YouTube video.

If you liked this type of content, you might check these videos as well:

- Thinking About Positioning | Axia Futures

- Where Are The Weak Positions? – Market & Volume Profiling | Axia Futures

- 5 Steps To Trade Against Overnight Positions – Trade Strategies | Axia Futures

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK