How To Trade a Failed Break Pattern Introduction

In this blog post, we will discuss how to trade a failed break pattern. We will take two videos discussing failed breaks and focus on the selection and execution part. The contrarian nature of failed break patterns can attract a specific set of traders. On the surface, it can look like the ideal strategy. If the market tends to range approx. 70% of the time, and trend “only” 30%, we must be on the right side of the assumption that trading a failed break must be a good strategy to choose from. But there is a reason why the failed break patterns are not so easy: momentum. Usually, the failed break patterns are formed at the extremes of the day and we have no way of knowing who needs to do business there until the very bottom has been formed. This can take one, three, or five stabs where each stab can create a new extreme and still push a market by a lot. Let’s have a look at how we can improve our failed break selection process. If you are into breakouts, this is our previous article you might like: Trading Market Profile Reversal Signals

Mechanics Of Failed Break Patterns

Trading Failed Break Pattern In Bund

In the first example, we will be looking at the trade example in Bund. With Bund, we have established the original low at 172.82 and rallied from there. Any initiative rally from the low is a good sign, that the low might get rejected in the future if we come back. If the low is poorly and mechanically formed (the market spent more time at the extreme leaving the ledge) and then rallied, there is a higher chance of a necessary repair.

Here is the video with execution in the Bund using the price ladder.

In our decision making and selection process, we should always evaluate two things:

- What was the prior positioning aka How We Got Here Principle

- Significance of the location where we are aiming for our failed break

In the Bund example, the significance of the location was done by the daily swing low that was formed in the past. In regards to prior positioning, the market has built enough energy to break from the 00 but was unable to push through the 70’s. Specifically, 78 was the level to play (see the first blue box).

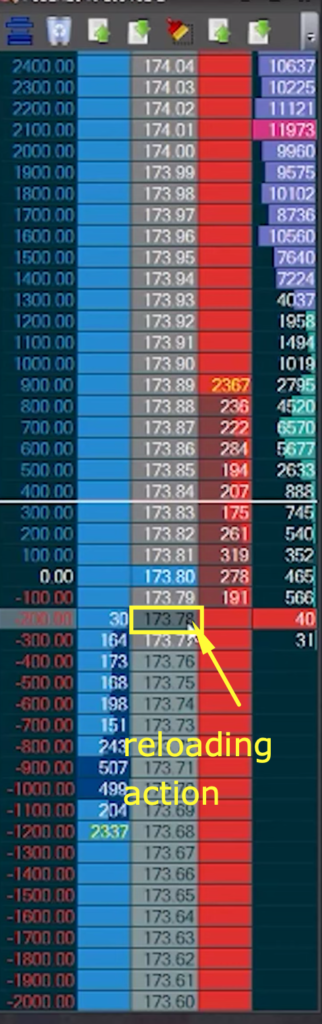

When it comes down to execution, when using the price ladder, we need to observe the action between the bid and offer. Ideally, we want to see a slowdown in selling pressure, bid reloading, and change from market hitting bid to market lifting the offer ideally with increased size. We call it a personality shift. If you want to find out more about the price ladder personality shift, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

In the case of Bund, it was apparent that sellers pushed to 77, the market came back to 78 and:

- sellers started to dry up aka slow down in selling – no one is willing to keep the move going

- the market started to reload with bids keep coming back

- personality shift from market hitting bid to market lifting offer

If you have missed the action at 78, there was a possibility to play the pullback fade back to 82 (second blue box).

Trading Failed Break Pattern In Spoo

Now that we have identified a couple of principles, I would like you to have a look at a different type of failed break in Spoo (EMINI S&P500). Here it is:

Now use the principles we have laid out in the Bund trade and answer these questions as a part of your debrief:

- Explain How We Got Here Principle for the Spoo trade

- What was the Significance Of The Location in Spoo

- How would you describe a Personality Shift in Spoo

Leave us comments under the video answering these three questions.

If you want to learn how we do it, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- Trading the V Reversal Price Action in the Dax | Axia Futures

- Reversal Entry Trade In The S&P | Axia Futures

- How To Trade The Delta Reversal Strategy [FOOTPRINT CHART]

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK