Elite Trader Execution In The Bond Space Introduction

In this article, we will have a look at the Elite Trader execution in the bond space. Specifically, we will have a look at two individual trades executed in the German Bund from the Axia Elite Trader playlist. Both trades were executed on the back of fundamental catalysts, the French election, and ECB Press Conference. Although both trades happen to be executed in the same product, their nature and management style is very different.

Each video will be accompanied by a theme and a learning question dedicated to improving your trade management skills so you can make the most out of the order flow mastery of these traders. On the importance of high-quality questions, we have also written an article (Trading Techniques To Become More Profitable Trader) you might find helpful.

Axia Futures Elite Traders Playlist

In case you have missed this, there is a whole list of high-quality content of Elite Traders videos that we have shared with the trading community:

Click on the image above or this link to find the full list.

Elite Trader Execution

Elite Trade Execution In German Bund During ECB Press Conference

Theme: This price ladder and order flow session looks at the unique execution style of one of the elite traders on the Axia Futures trading desk. Even during a relatively quiet ECB Press Conference, we look at how he was still able to scale up a position of over 200 lots with only 1 tick of risk.

In slower market conditions good risk-reward opportunities are what matters most, and knowing how to leverage up with greater conviction. Adam notes that one of the factors helping this trader have confidence in the trade was the negative correlation between the EURUSD and Bund futures market.

With small targets, this trader was able to dynamically manage his size and never risked going more than 1-2 ticks offside. As the Euro began taking out its low, the trader slowly fed clips into the Bund market. However, he was equally quick to scale out of the trade, as the last thing anyone wants is to be caught offside during a risk event by a surprise statement while trading large size.

Finally, after seeing a maximum extension of 10 ticks in the Bund, the Euro began showing signs of bouncing and provided the extra information this trader needed in order to scale right down and be on the watch for the completion of the move.

Execution: Starting with 20lots, the trader starts slowly. While Euro is hitting the lows, this trader adds passively to his trade increasing size to 50 lots and then to 130 lots. The goal of this trader is to constantly lay orders to get in and out sizing up to the total of 190 lots and scaling out with 10 lots per price. As the trade gets closer to the highs, this trader narrows down his focus even more because the market can become more reactive at the highs. He is not willing to get any major exposure right at the highs that would endanger his position or his profits. Given the reaction at the highs, he is not stubborn and scales down back from 190lots to 50lots but holds his core position open.

As the Euro takes the lows again, this trader is willing to put back more size. Laying down the bids at 11 and 12. Getting filled at 12, with 80 lots, adding more size at the 13. If Euro takes the low, we should see the highs get taken again in the Bund. He adds additional 30lots but being filled only partially this is a good sign that market might start lifting the offer more aggressively. With Euro still hugging lows, this move has at least 5-10ticks more to go. Given the increased speed of the move, he starts to scale down with only 5lots instead of 10 to stay in the move as long as possible until the trade reaches the desired target and the pace slows down.

Price ladder recording starts here.

Questions:

- What was the correlation this trader was leaning on?

- What was the scaling-out technique when the trade started to work well in a favor of the trader?

- How the trader reacted, when the market reached the highs for the first time?

Elite Trade Execution In German Bund On French Elections

Theme: This trader executes immediately at the Eurex open in the German Bund. The expectation is for the German Bund to react immediately after the open and follow lower given the result of the election. The main goal is to get as aggressive as possible right at the open.

Price ladder recording starts here.

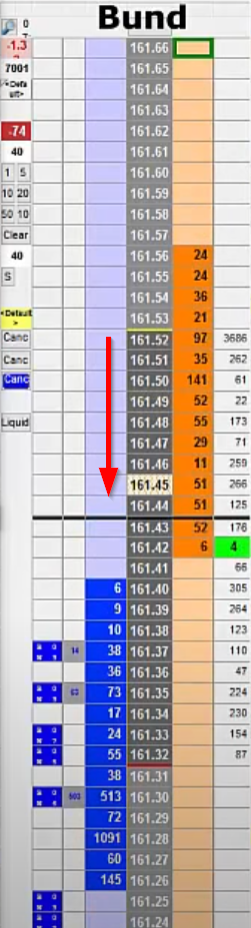

Execution: The trader gets 161.52 with 14lots, quickly increasing to 74lots with an average of 161.45. Exits the majority of the position quickly leaving 10lots and starts adding again.

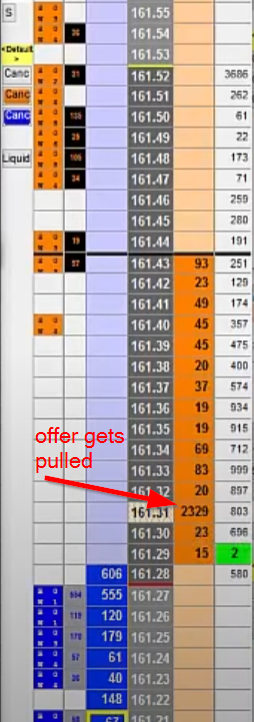

Scales up to 100lots again seeing 2324 lots (see image below) on the offer giving him extra confidence. Market can’t offer anymore and quickly lifts the offer moving higher through the original 2324 at the offer that gets pulled. This is a signal for a trader to scale down dramatically back to the 24 lots. Holding the average size for a while getting squeezed a bit and adding back again up to 88 lots as the price starts to move lower. As the pace slows down, you can see how this trader slowly winds down the position and keep the average size around 20-30lots until the trade potential fizzles out.

Questions:

- When did the trader initiate his first trade?

- What was the scaling-out strategy of this trader?

- How did the trader manage his size when he got offside?

- What did the trader do with his size when the 2329 lot got pulled from the offer?

Now go back to the recordings and rewatch the price ladder execution for yourself. Seek answers to the questions above. Also, if you want to find out, how to recognize price ladder personality shift and exit trade ahead of the crowd for the best possible price, join us at the free webinar we are running at: https://www.elitetraderworkshop.com.

Thanks for reading.

Don’t forget to check out articles you might also like:

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK