Algo Trading Strategy You Can Beat Introduction

In this blog post, we will review an Algo trading strategy you can beat. Trading algorithms are many times perceived by traders as these powerful decision-making enemies that are smarter and faster than us. Yes, they are definitely faster, but you need to understand that they simply follow a set of instructions on which they need to execute. They have a clearly defined risk profile (covering the position), size management, and steps they need to follow. Understanding what their weaknesses are can give you an advantage in formulating a strategy that can actually beat them. Let’s have a look at what we mean by that.

The content of this post is based on the video down below:

Beating The Trading Algo

How Trading Algo’s Operates

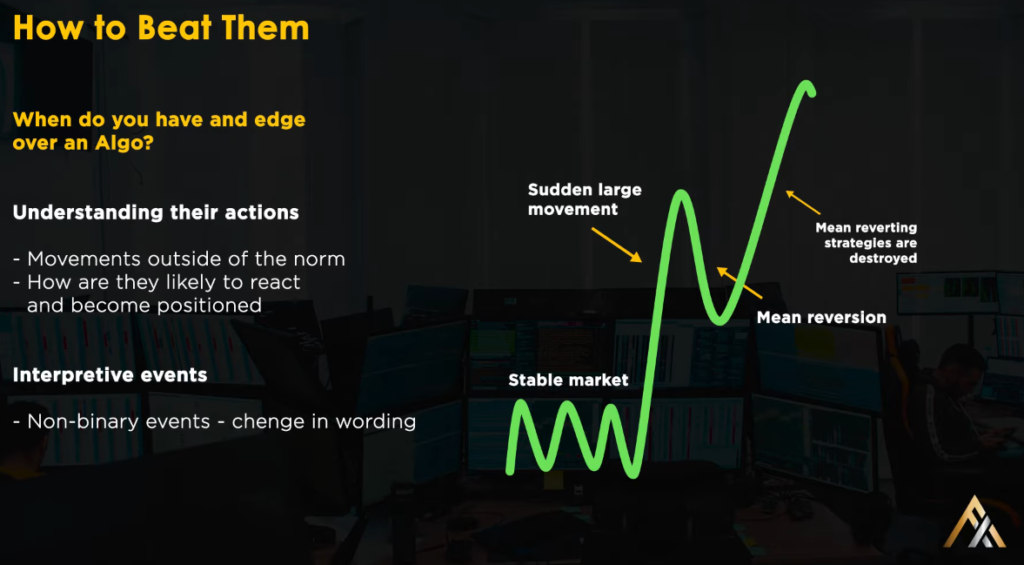

We must understand that algorithms operate on the basis of statistical norms. Their execution is emotionless. This is their first great advantage. Another indisputable advantage is their ability to instantly react to data. Rather than trying to beat them in their superior domains, we should focus on moments when they are actually already in a position. Like you and me, they have to offload the liquidity they have acquired. That is one approach we can take in order to beat them.

The second approach is non-binary events. Algorithms can’t trade around non-binary events. In a grayscale of an event, algorithms are still having a hard time interpreting it well, lacking the emotional ability in the voice tone shift or stories implications.

With many more examples that we won’t cover today, a goal of a human trader is to reverse engineer their “code” and use it as an advantage. Let’s have a look at one of the many Algo strategies we can reverse-engineer.

Example Of Mean Reverting Trading Algo

Imagine yourself in a situation when the market is trading in a well-defined range, average volume, no dramatic shifts. Suddenly a large move, multiple standard deviations of scale happen. The algorithm calculated, based on statistical data, that this event is likely to reverse into the mean and starts to load size in the opposite direction of the move. It follows predefined rules. But there is one thing it cannot do well, which is to interpret the news. You, on the other hand, having the right amount of knowledge can. And that is your advantage.

As the Algo loaded size, the second this move stops mean-reverting, that is your advantage. You understand the reasoning why the move happens and why it stops, the algorithm is holding large order it has accumulated and will seek liquidity to exit the move the moment it stops going, which will push prices in the opposite direction. In simple terms, the moment it goes wrong (not according to the statistical plan), they have to get out and that is your chance to profit from it.

Key Trading Takeaway

The key trading takeaways are:

- don’t try to beat them, try to understand how they operate

- understand how the Algo operates via the rever-engineering method

- prepare a strategy that will use their weakness to your advantage

Thanks for reading.

If you liked this type of content, you might check these videos as well:

- Example Of SPOOFING On The Price Ladder | Axia Futures

- Observing A Fake Bund Order – Price Ladder Trading | Axia Futures

- 1 Secret To Understand The Price Ladder (Volume Traded) – Live Trading | Axia Futures

Do you like what you have been reading? If you would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading again and until next time, trade well.

JK