Prop Trading Risk Management Tips Introduction

In this blog post, we will review several prop trading risk management tips. As traders, watching the risk should be our number one priority. Especially when we start, our goal is to stay in the game as long as possible. Our goal is to learn, experience different environments, and find a trading style that suits us. At this stage it is not about making money, but about not losing our account so we can be here for the next trading day. We have broken down three trading risk management tips that we constantly trying to work on. Dynamic sizing on high conviction setups, the ability to zoom out to stay objective, and the ability to recognize a change in our trade assumptions before they turn into a losing trade.

Three Tips To Improve Your Risk Management

Zooming Out In Your Trades

During this session from the trading floor, Isaac explained his lessons from taking a hit during the Iran Oil deal. To every market-moving news, there is a rhythm we should be aware of. In this particular case, the lessons for this young trader were:

- The subtle the announcement is, the more time it will be necessary for the market to price in the news

- The price ladder during these times can be too narrow, you must zoom out

- You will need to understand the broader structure to attack the market with manageable risk

Here is a debrief of the trade after it dropped 600 ticks in a not so straight away fashion.

Actionable Risk Management Takeaway

Price action must confirm our thesis, otherwise, we are either too early or the market simply does not care.

ZOOM OUT to get the perspective on the market response and market structure

Absorption

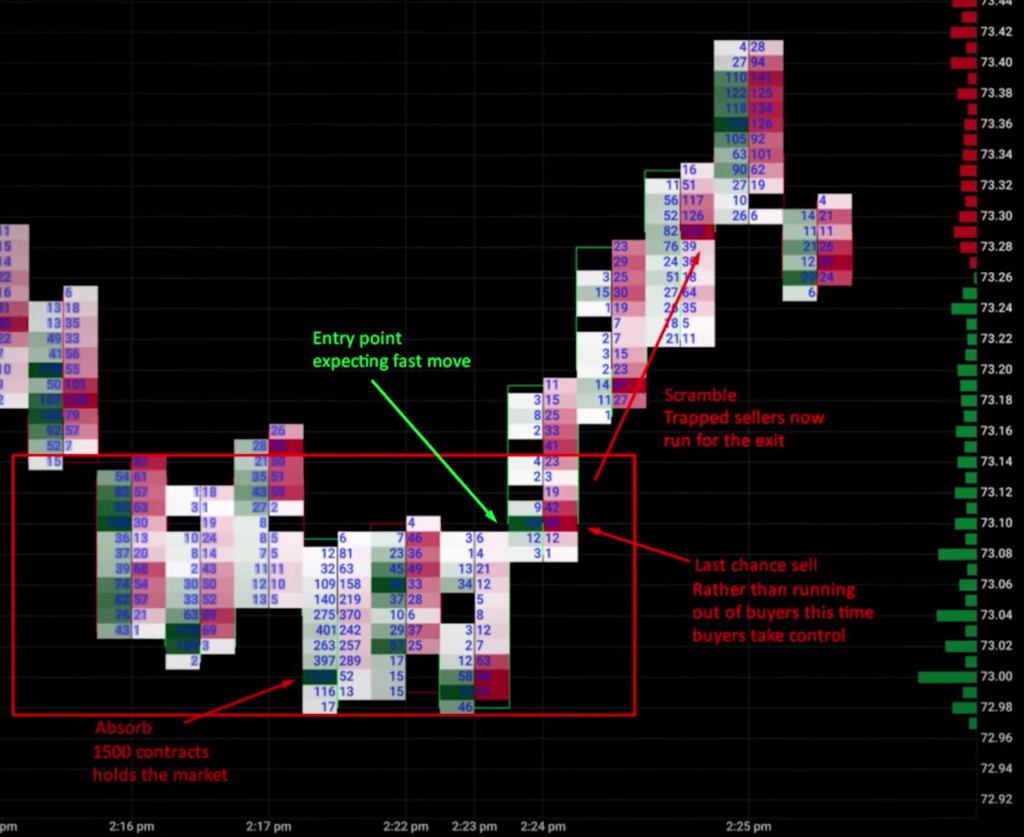

In this case, the risk management tip is all about recognizing that the anticipated move ain’t gonna happen. Tools such as Footprint and Price-ladder can help you greatly. If you want to learn more about how our traders use these tools, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

Recognizing the absorption on the Footprint could not only save you from a loss of a short trade but also that fast change that happened at the opposite inflection point (higher part of the range) could have been your trigger for a long trade.

Actionable Risk Management Takeaway

After absorption occures, a sudden pickup of pace at the opposite inflection point leads to a new vertical move

Dynamic Risk Management

Opportunity is independent of time.

When you lose a lot in a high conviction trade and you get stopped out for a day, you should not just pack things and head home. Especially if there is a high chance of another high conviction trade around the corner. As long as our mental state is in a good shape, we should be able to push for more. Ask for more risk and dynamically manage our risk. That’s how professional risk management should be done thriving for maximizing the opportunity independent of time.

Actionable Risk Management Takeaway

Dynamic position sizing is one of the strongest weapons Elite traders have

Thanks for reading. If you liked this type of content, you might check these videos as well:

- Junior Funded Trader 2020 Performance Review

- Lessons From My Biggest Trading Loss

- Trader Training: How Long Does it Take a Trader to Become Consistent and Profitable | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK