The idea that day trading profits can be increased by ‘cutting your losses and letting your winners run’ is an oft-quoted phrase. The problem is, the generalised usage – when should you let winners run and when do you cut your losses? The bigger unnoticed issue is the psychological difficulty it presents in your trading because of the suggestions of the phrase – let winners run implies uncertainty, whereas cut losses is definitive, therefore it is easier to quantify cutting losses and so more focus is put on that part of the adage. But cutting losses without being wrong can actually do the opposite of maximising trading profits.

Should You Prevent Losses To Maximise Profits?

As it is easier to focus on not losing to maximise trading profit; one of the most commonly used strategies is to move your stop to scratch once the trade is on side. This makes sense, right? With a stop at scratch how can you possibly lose? Whilst this does serve to prevent losses, invert the idea and what it also does is prevent winners too: Any test back to your entry point gets you out thereby not maximising profit but in fact reducing profits. Lets take a look at this problem from a logical stand-point, next time you are in a trade (for this example, long) and your are about to move your stop to scratch ask yourself these 2 questions:

- If it trades back to my entry point, am I wrong on the trade?

- If I wasn’t in the trade would I sell there?

The answer to both questions, in most cases is going to be NO and so moving your stop to scratch doesn’t serve to maximise trading profits but in fact increases the chances of reducing them by making it more likely you will exit the trade with nothing despite never being shown you are wrong on the trade.

Why Scratching Trades Doesn’t Maximise Profits

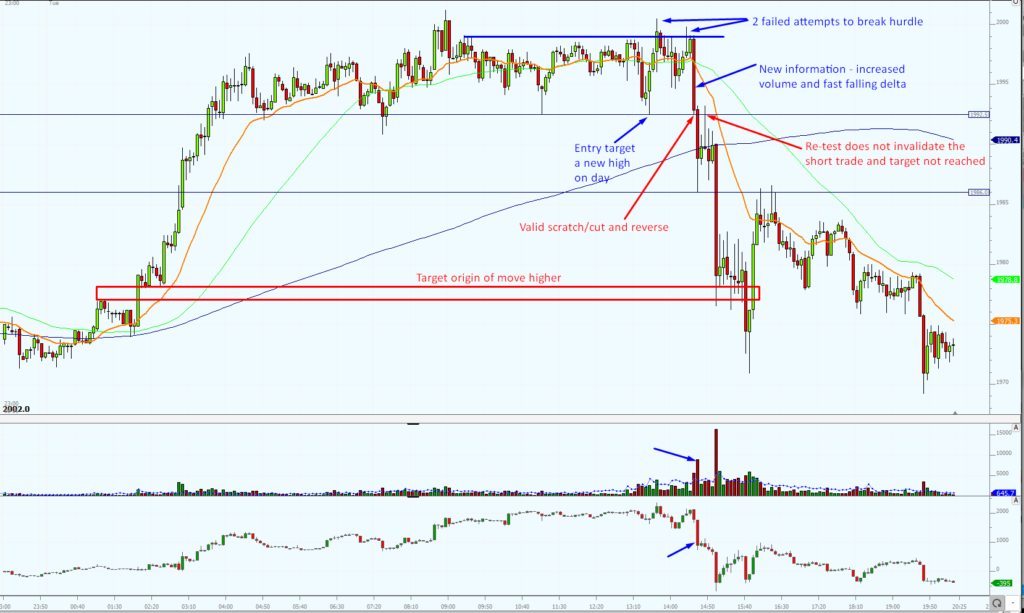

There are certain situations where scratching a trade can help to maximise profits but these situations are few and far between. Take the example in the chart of Gold on 1st September 2020, below. The initial trade, indicated by blue text is a trade where a scratch after entry could be valid, however some key information had been gained by that point: From the entry point a target of a new high would be sought but when gold fails to break it’s hurdle to a move higher (blue line) twice an exit could be indicated, particularly when the drop back to scratch comes with higher volume and falling delta – both indications that sellers are in control at the point in time. In contrast the second trade (red text) is a prime example of where bringing a stop to scratch does the exact opposite of maximising profit: If the breakout short trade had been executed the bounce back to entry could in fact be an opportunity to add to a trade as it had not been proven wrong. Imagine you were not in the initial drop – would you be considering buying or selling that pull back? The answer shouldn’t change whether you have a position or not. This trade and one more were explained in the weekly mentored trading stream where members questions get answered. The video can be seen here

So the 1 simple way to maximise day trading profits is to ensure you are not scratching trades without due cause – a clear appreciation of risk is of course paramount and is a key element of our trader training courses, in particular our 8-week career trading course. All elements of risk management are crucial to maximising profit, reducing scratches is one element but the recognition that scratching a trade not only prevents losses but also prevents profits is an important adaptation of the phase “cut your losses and let your winners run”

Richard