Fix The Root Cause Of Your Trading Mistakes Introduction

In this blog post, I will be talking about one approach how to fix the root cause of your trading mistakes. We have all been there. We do a mistake, promise ourselves we will never do it again and then we mess up. Again! The problem in many of the cases is our brain wiring of how we deal with mistakes. More importantly, how we deal with fixing those mistakes. Since our brain, most of the time runs in a Fast mode (read Kahneman’s Thinking Fast And Slow), the first solution to our problem is usually the one of the addition, not the one of subtraction. Most of the time, we introduce a rule, a crutch to overcome the issue, and not really a fix of the underlying issue. So how can we do that? How can we actually fix the root cause problem? A lot has to do with “stillness”.

Dealing With Fast System In Your Trading

In the video down below, Branigan introduces one concept of how he is tackling his overtrading behavior.

In the video, he talks about how he does not fix his issue just by introducing the new rule. He goes deeper. He is accessing his slow system by thinking deeply answering the key question:

What is the underlying beahaviour leading me to overtrading?

What he describes is the breakdown of the multiple factors:

- Lack of Preparation.

- Impulsiveness.

- Noise (too much “noise” aka Information Overload)

- Lack of Trust

Why is this breakdown important? It demonstrates the acts of not being still enough to actually trade well. It introduces behavior that leads to overtrading. These are his compounded triggers. So how can we introduce this stillness in our own trading?

Stillness Is The Key

As Ryan Holiday writes in his book, Stillness Is The Key:

“So much of the distress we feel comes from reacting instinctually instead of acting with conscientious deliberation.”

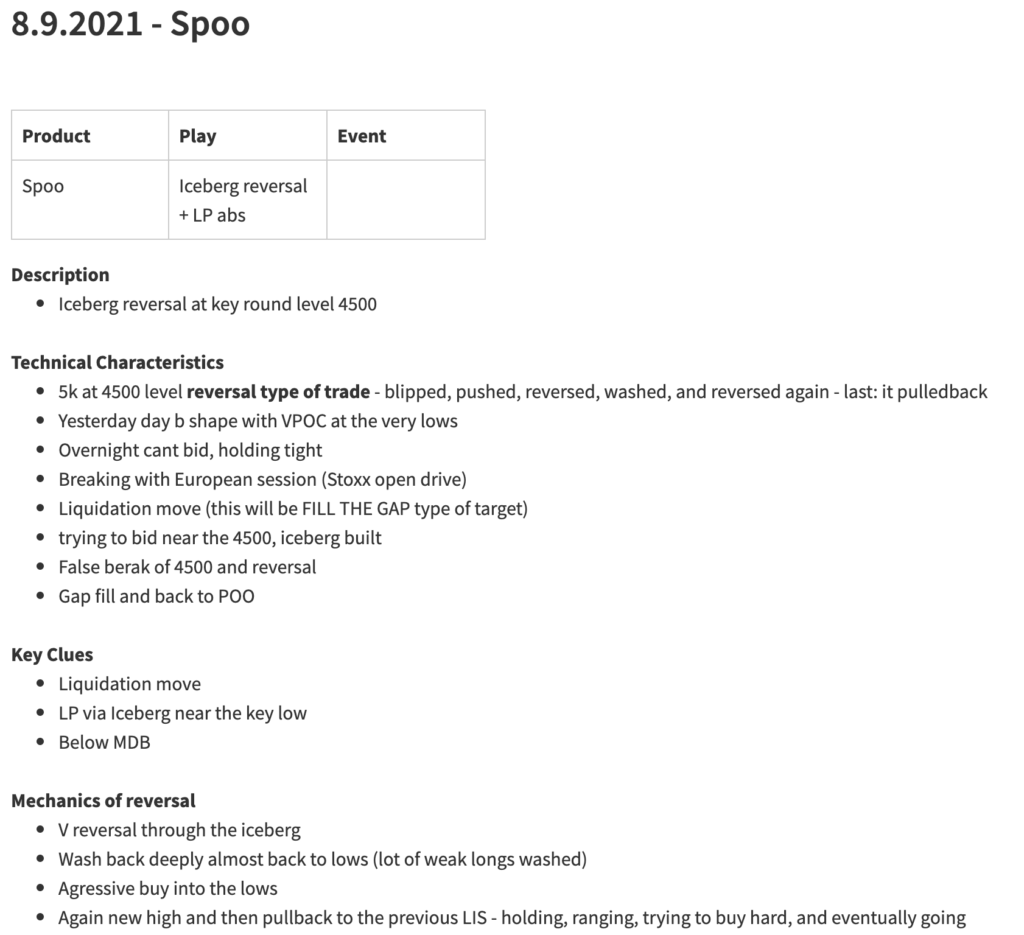

We react based on our wiring. The core of the wiring is similar for most humans but we all react differently to different triggers. So what is the stillness one needs to build in order to become a better trader? As always the devil is in the detail. I have observed over and over that stillness can’t be built by putting a sticker on your monitor: “be patient”. Patience comes from knowing what you are good at. And then, you deliberately perfecting it over and over again. You make it 1% better every time you trade it. I have noticed that once you become obsessed with the thing of making your PLAY better, you will become less reactive, you start to introduce more stillness in your game. And that stillness will lead to less reactiveness because you will know exactly what to look for. What do I mean by that? Here is a partial excerpt from one of my debriefs:

What you can see above is me trying to describe all the clues that I have seen in a particular play. This is followed by many screenshots from all different angles. Profile, Footprint, 1sec chart, 2minute chart, big picture chart. Annotating. Trying to beat the crap out of it in the debrief. What have I seen? What did I miss? What can improve my clarity? Where I could get bigger? Where I could get a little bit more patient and why? I am obsessed with repeating these debriefs over and over and over again. Like a mad man. If I have to write down every time 10 same things I have seen. I will do that! Why? Because I know that in the long run, it builds my stillness. And, suddenly, after many iterations, I start to see new things because the previous knowledge has been integrated so deeply, that suddenly I have the capacity to see new stuff.

Key Takeaways About How To Build Stillness

All of what I have described strengthens what Bran talked about. The better I prepare, the less impulsive I become. The bigger detail I deliberately build with each of my plays, the higher trust I have for my play. Confidence comes when the ability to read the market clearly becomes deeply integrated. And that only comes after being obsessed with your play from A to Z over and over until you become much more still when waiting for your play.

Thanks for reading, don’t forget to check our content on AXIA Instagram.

The articles you might also like:

- Trading Psychology: How To Develop The Skill of Discipline | Axia Futures

- How To Deal With Missed Trading Opportunities – Trading Psychology | Axia Futures

- Trading Psychology: Why Top Traders Embrace Pressure | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK